Charles R. Goulding and Preeti Sulibhavi examine the incredible growth and recent acquisitions of Nano Dimension.

Nano Dimension has been in the news lately, this time for making:

- Small acquisitions of Admatec and Formatec, two Dutch ceramic and metal parts manufacturers

- A surprising US$150M 12% investment in 3D printing pioneer, Stratasys

The US$12.9M acquisition of Formatec follows a series of 4 acquisitions including Deep Cube (US$70M), Nano Fabric (US$55-$60M), Essemtec (US$15-25M), and GIS (US$18.1M).

These acquisitions and investments follow Nano Dimension’s large public offerings in 2020 and 2021 of almost US$1.5B. It was noted that before the Stratasys acquisition Nano Dimension still had US$1B to spend.

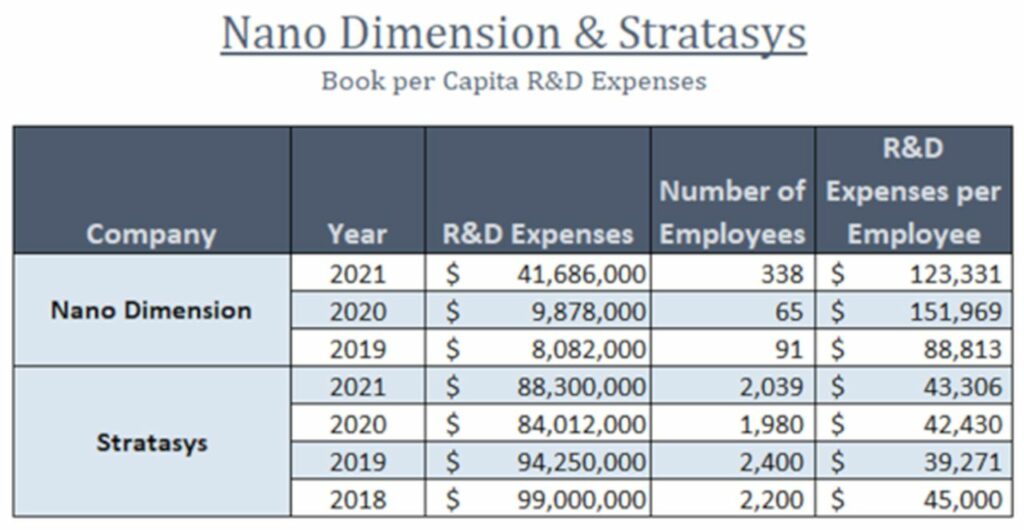

The US$1.5B war chest was a timely accomplishment before the economy began to slow and because the market was impressed with the company’s Additive Manufacturing Electronics (AME) strategy. In 2020 Nano Dimension had only US$3.4M in sales, and they grew to sales of US$10.5M and 345 employees in 2021. The company is growing at an astounding rate; the rate of increase from 2020 to 2021 revenues amounts to 209% in growth.

AME is a critical technology for the defense industry, consumer electronics, aerospace, automotive, and telecom. Important end-use applications include drones and satellites.

Nano Dimension CEO, Yoav Stern, has commented that investing in a relatively seasoned company (Stratasys) with disruptive technology was strategic. Before the Stratasys acquisition Nano Dimension was arguably itself at the risk of being acquired since its low stock market valuation of US$850M was less than the US$1B in cash on hand. Stratasys has struggled in recent years and has undergone multiple CEO changes and its own series of acquisitions.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

The recent series of events described above is of major impact on the 3D printing industry. There is clearly more to come in this developing story.