Charles R. Goulding and Joseph Castine take a look at an innovative company’s use of 3D printing and other technologies in the face of pandemic.

Nottingham Spirk is a business innovation and product development firm founded in 1972 by John Nottingham and John Spirk in Cleveland, Ohio. This innovation powerhouse partners with companies in consumer, medical, and retail industries to help facilitate the creation of a vast pool of products. The company is known for its use of the vertical innovation concept coined in 2011 to describe its process, which takes a new product concept and turns it into a tangible item in a compressed time frame. In Spring 2021, in a partnership with Ernst & Young, it will be opening a 60,000-square-foot innovation hub, which will house Nottingham Spirk’s design and product development offerings with EY digital, manufacturing and design and collaboration capabilities.

In addition to established companies, Nottingham Spirk also has a focus on fostering innovation among students. Nottingham Spirk was pleased to get in on the ground floor of Case Western Reserve University’s Sears think[box] facility. CRWU is already a top-20 school for research funding with expansive research into 3D printing. With this venture “we want to work with students and faculty to help them reach the marketplace more quickly,” according to Nottingham Spirk Vice President John Spirk. When the COVID-19 pandemic hit, Nottingham Spirk was able to leverage this relationship to provide much-needed aid for the PPE shortage.

Nottingham Spirk on COVID-19

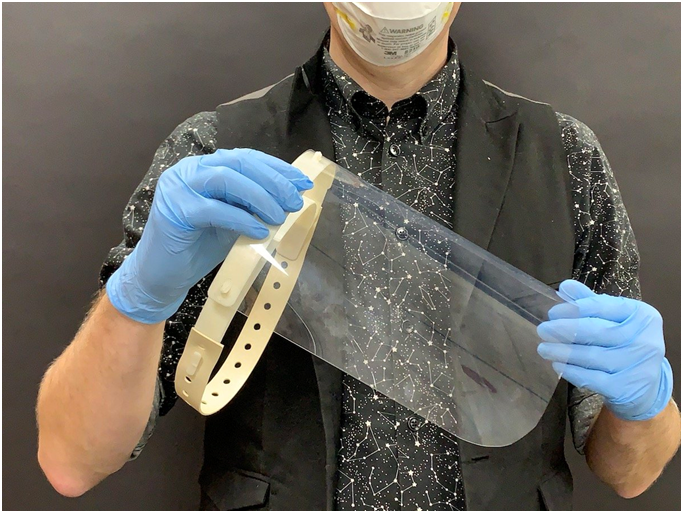

It’s no secret that in 2020 many manufacturing companies and producers shifted their focus to supplying PPE for first responders and the public, and Nottingham Spirk was no exception to this phenomenon. In their partnerships with Penn State Behrend researchers and CRWU’s think[box] innovation team, Nottingham Spirk aimed to create and produce face shields that would be mass-producible for medical professionals.

In order to accomplish this, Nottingham Spirk used a 3D printed model to adapt into an injection mold to scale up the production of the face shields more quickly. Ian Charnas, the director of innovation and technology at CWRU’s think[box], mentioned that 3D printed materials can be difficult to sterilize but they can provide a good prototyped stepping point for the development of injection molded products. Injection molding is far quicker and more mass producible than 3D printing, while also providing non-porous materials that can be more readily sanitized. Nottingham Spirk’s use of its relationships helped in getting more mass producible face shields out to the frontline workers during the COVID-19 pandemic.

Nottingham Spirk, with its enormous research and development endeavors, as well as smaller companies involved in 3D printing developments and research ventures may be eligible for Research and Development (R&D) tax credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Nottingham Spirk has its hand in many different markets, with many diverse opportunities. Because of this, Nottingham Spirk was able to use its partnerships to help shift focus to the production of PPE for frontline workers and, through this venture, 3D printing provided a crucial stepping stone towards mass-producible face shields. Even in these uncertain times, Nottingham Spirk continues to find ways to expand its reach and develop new products and processes with an innovative approach.