Charles R. Goulding and Peter Favata consider SABIC’s contributions to industrial 3D printing.

Saudi Basic Industries Corporation (SABIC) is a petrochemicals company headquartered in Riyadh, Saudi Arabia. Founded in 1976, the company employees over 33,000 people in over 50 countries. They are 70% owned by Saudi Aramco and 30% publicly traded on the Saudi Stock Exchange. In 2019 SABIC had net profits of $1.5 billion, total assets of $82.6 billion, and overall production of 72.6 million metric tons. The company creates products in a variety of fields including polymers, chemicals, agri-nutrients, metals, and specialties.

SABIC has a relationship with Nottingham Spirk, a business innovation and product design firm based out of Cleveland, Ohio. Spirk will use SABIC’s diverse inventory of materials involving high-performance thermoplastics and compounds to further their innovation.

Additive Manufacturing

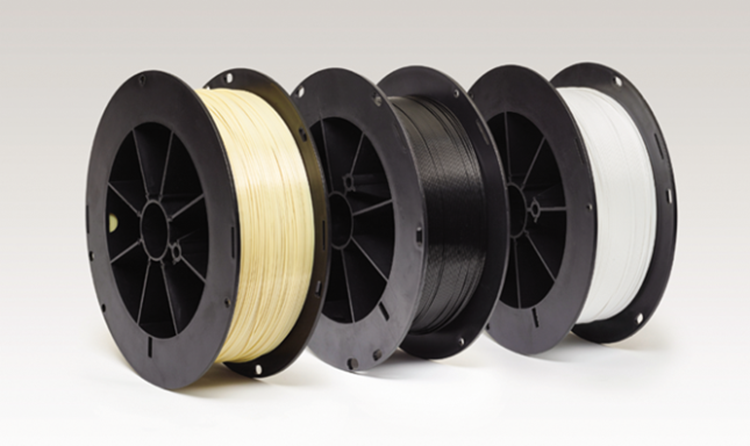

SABIC makes a range of filaments, SLS powder, and specialty compounds that can all be used for additive manufacturing.

SABIC’s filaments are available for use in Stratasys and Fortus classic printers, as well as all open materials 3D printers. These filaments are made to have four times the impact strength compared to polycarbonate filaments. The company’s engineering-grade materials offer high-performance attributes like high strength and extreme high-temperature resistance.

Another product SABIC produces is a polycarbonate SLS powder to be used for selective laser sintering processes. The powder has good mechanical properties and high-temperature resistance, making it useful for many different applications. The powder is compatible with most SLS printers and can be recycled up to 100%.

Companies developing 3D printing materials may be eligible for Research and Development Tax Credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

With more and more businesses and individuals utilizing 3D printing, more choices for printable material is needed. SABIC creating a large variety of 3D printing material is making sure companies have those options.