Here we present ten 3D print companies that just might be of interest by other, larger companies.

Acquisitions are a thing in the 3D print space, as they are in most industries. The usual pattern is that there’s a mad scramble at the beginning with plenty of small players vying for market space. Eventually a few will have the right combination of products, services and costs to grow larger than most, and they become the dominant parties in the industry.

But once dominant, these companies tend to keep their dominance by scooping up new technologies and markets from newly acquired smaller players.

We absolutely see this pattern in 3D printing, now more than ever, as there are now multiple large organizations on the hunt for new ways to diversify their portfolio of technologies.

But which companies might be considered for purchase. I have some ideas.

Why Would Companies Acquire Others?

There are several reasons why a larger company might acquire a smaller one, but here are the most basic strategies:

- To gain access to a complementary technology and broaden the joint product set

- To gain access to a large sales and distribution network

- To offer access to a larger sales and distribution network to new products

- To consolidate similar technologies and save on shared costs

- To take a competitor off the market

- To enter a new region dominated by the acquired company

- To eliminate “bad news” before it becomes public

You get the idea: there are tons of reasons, but all point to greater profit, either immediately or in the future.

What Companies Do The Acquiring?

The companies in a position to perform takeovers are obviously the ones with cash, high valuations or other assets at their disposal. In other words, the big companies.

But there’s more to it than that. Some companies have specifically been growing their portfolios of 3D print processes lately, in an attempt to “cover all the bases” when their growing sales forces encounter new types of buyer requests.

The companies that I see possibly making further acquisitions include:

3D Systems: Have historically acquired the more companies than any other, mostly years ago, however. But recently they’ve been busy picking up some strategic organizations, like Oqton.

Stratasys: In the recent past while they’ve landed Origin, Xaar 3D, and RPS. Having recently acquired those companies, it’s not unreasonable they could do more to continue the pattern.

Desktop Metal: Initially offering an inexpensive metal 3D printing solution, the company raised a significant amount of investment and has been on a tear acquiring many companies, including EnvisionTEC, ExOne, and multiple others.

Markforged: Similar to Desktop Metal, the company has been leveraging their assets to acquire companies like Teton Simulation and Digital Metal.

Protolabs: A major manufacturing service, they acquired 3D Hubs recently (now known as “Hubs”).

Xometry: Currently the biggest publicly traded 3D print company on our weekly tracker, they have the resources to gobble up almost any company they choose.

Materialise: A Belgian software company that’s long been in the industry, they recently acquired Link3D and could be in a position to do more acquisitions, particularly in the software domain.

Xerox: Entered the metal 3D print space with the acquisition of Vader Systems, and if they wish to broaden their portfolio further, they must acquire more.

HP: First dabbled with relabeled Stratasys gear to orient themselves in the industry, then later launched their own MJF technology. The company could broaden their technology portfolio with acquisitions.

EOS: The long time polymer and metal 3D printer manufacturer has not yet made significant acquisitions, but seeing many of their major competitors do so might provoke them to take notable action.

Nexa3D: A well-funded startup led by Avi Reichental, who led the 3D Systems acquisition strategy years ago. Nexa3D has made some notable acquisitions, and could do more.

Velo3D: Producer of a powerful metal 3D printing system, the California company could benefit by broadening their portfolio, as their products print only in metal, but they may be held back by their challenging and seemingly volatile valuation.

Formlabs: Maker of SLS and SLA 3D printers, the company hasn’t yet made major acquisitions, but with recent funding and increased valuations is certainly in a position to do so. Their addition of SLS 3D printing indicates they are willing to broaden their product set, but will they do more?

GE Additive: The company made a splash a few years ago by gobbling up several metal 3D printer manufacturers, but has been relatively quiet since then.

What 3D Print Companies Could Be Acquired?

I’ve gone through my lists of 3D print companies and come up with a list of ten potential takeover targets. My thinking is that each has some combination of the above reasons, and notably has proven their technology to a sufficient degree. There are certainly more than ten takeover targets; I simply believe these could be among the most interesting to buyers.

Note that many small companies truly benefit from such an acquisition, as they can gain a massive boost in investment and particularly increased sales reach through existing larger networks.

These are in no particular order, and a disclaimer: I have no knowledge whatsoever of current acquisition talks involving any of these companies. I simply think big companies might see these as juicy acquisition targets. Whether they actually do or not, I cannot say.

Massivit

What They Do: Their unique GDP process can print very large objects quite rapidly. Recently they’ve leveraged that into a unique method of printing huge molds for large polymer objects in engineering materials.

Why They Could Be Acquired: Their new casting technology could have a massive (pun intended) impact on several industries, and that potential should attract acquirers.

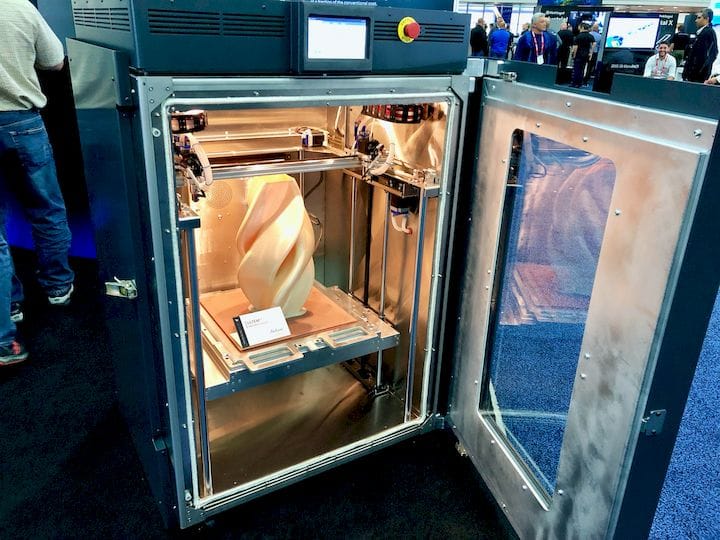

AON3D

What They Do: The Montreal company produces a very well-regarded high temperature 3D printer that’s growing rapidly in the market.

Why They Could Be Acquired: Some companies don’t yet offer “HT” capabilities, even though it is of strongly growing interest. By acquiring AON they could immediately enter the HT market.

Minifactory

What They Do: The Finnish manufacturer produces high temperature 3D printers designed for production, and includes a means of automated quality control tracking.

Why They Could Be Acquired: Similar to AON, a Minifactory acquisition would be a way to quickly enter the HT market.

Wematter

What They Do: The Swedish company produces a sophisticated SLS 3D printer.

Why They Could Be Acquired: For a company without SLS products, Wematter could offer that capability instantly, and Wematter would benefit from a much larger sales network.

9T Labs

What They Do: 9T Labs has developed a method of 3D printing objects with 60% continuous carbon fiber, the strongest polymer parts yet printed.

Why They Could Be Acquired: 9T Labs offers one of the most unique and highly desired technologies, but again could benefit from partnering with a large sales force.

xolo

What They Do: xolo is the first company that has announced a commercial volumetric 3D printer, but has yet to deliver it. Volumetric 3D printing is able to produce objects as much as 100X faster than today’s fastest devices.

Why They Could Be Acquired: Volumetric 3D printing is so powerful it could eventually become the standard approach for many types of printing. By acquiring xolo early, it might be possible to gain a volumetric lead by injecting investment into xolo’s product development.

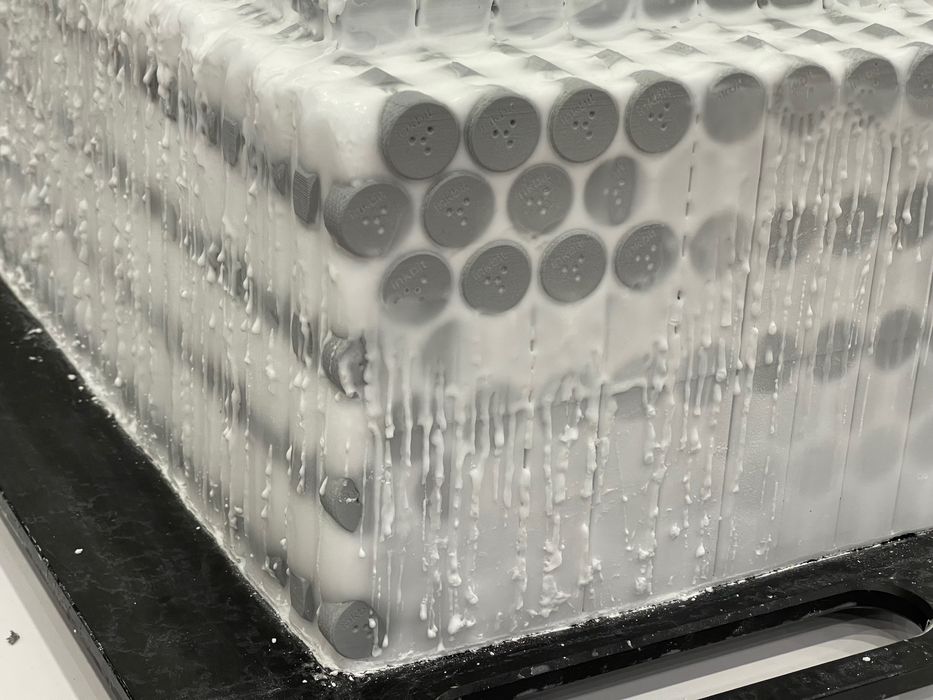

Mosaic Manufacturing

What They Do: Originally developing the Palette accessory for color 3D printing, the Toronto company now produces a very functional production array 3D printing system that’s quite scalable.

Why They Could Be Acquired: Low volume manufacturing is a strongly growing need, and it’s best serviced by array systems and farm operations. The acquirer could immediately gain significant production technologies for their customers.

Inkbit

What They Do: The startup company offers an unusual 3D printing process that is able to produce huge volumes of parts with great throughput.

Why They Could Be Acquired: Any large company that presently doesn’t have a product that offers low volume production could be interested in Inkbit for that capability.

Aurora Labs

What They Do: The Australian company is developing a revolutionary approach for rapid LPBF metal 3D printing, approaching one tonne of printed metal per day by a single 3D printer.

Why They Could Be Acquired: If and when this technology is perfected, it would open up many new markets for the lower cost tech. Aurora Labs could benefit from additional investment and assistance to complete their development more rapidly.

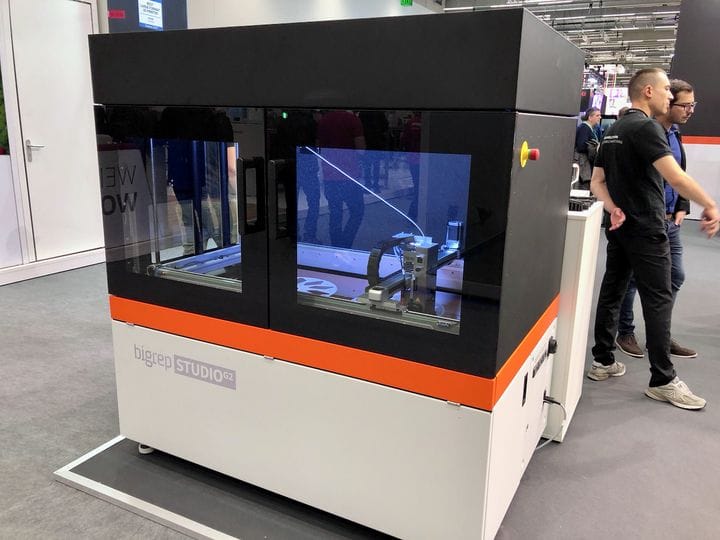

BigRep

What They Do: Produces large-format 3D printers for industry use.

Why They Could Be Acquired: BigRep is one of the very few successful large-format 3D printer manufacturers, and they’ve discovered a profitable market niche that could fit into the portfolio of many larger companies that don’t currently offer large-format solutions.

And that’s it. There are likely many more possibilities for acquisitions, but I think this could be a good list for some large players to examine.