Charles R. Goulding and Preeti Sulibhavi examine a new 3D printing partnership between Würth and Baker Hughes.

Würth USA Inc., the world’s largest fastener company through its North American subsidiary Würth Industry of North America (WINA), and Baker Hughes, the huge oil and gas company, have announced a very interesting 3D printing partnership to perform 3D printing digital inventory services. The respective sales and employee totals for the two giants are as follows:

Würth Group Baker Hughes

Sales $15.5 billion $23.8 billion

Employees 71,000 60,000

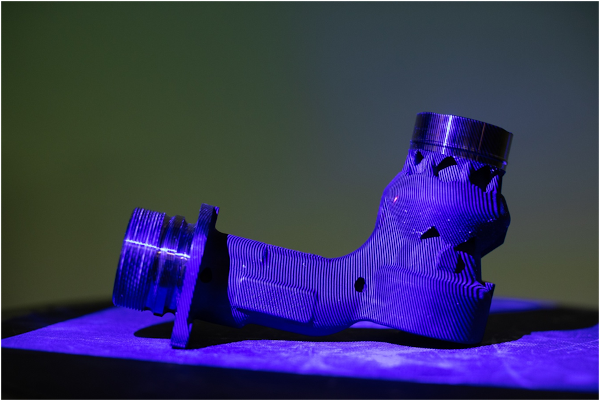

We recently wrote about Baker Hughes’ 3D printing expertise in our oil and gas industry restructuring article. There are big data aspects to this transaction since WINA has a huge customer list through its fastener business, which WINA will give Baker Hughes access to. Baker Hughes has 3D printing and equipment design expertise that is transferable outside of its noted renowned oil and gas business, including space and carbon capture. WINA also has a partnership with Markforged, a leading metal 3D printing company. Baker Hughes has direct access to GE’s 3D printing expertise since GE owns 37 percent of the company.

In the service business, having two major 3D printing alternatives is important for best positioning 3D printing assets for the company being serviced.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

This is an important partnership that the entire 3D printing industry will be closely watching. For the 3D printing industrial market overall, this is a very good development.