Charles R. Goulding examines GE’s Q3 2020 results with an eye toward 3D printing impact.

GE’s business challenges in recent years including earning declines, business divestitures, and layoffs are well known. Hence, it was a welcome surprise to see GE have improved profit margins and $500 million in free cash flow for the third quarter of 2020.

GE had made substantial investments in 3D printing in recent years and did not divest its core 3D printing assets. All four business segments had positive trends:

- Health Care — This segment was GE’s strongest performer and had favorable results in ventilators and imaging two product lines with 3D applicability.

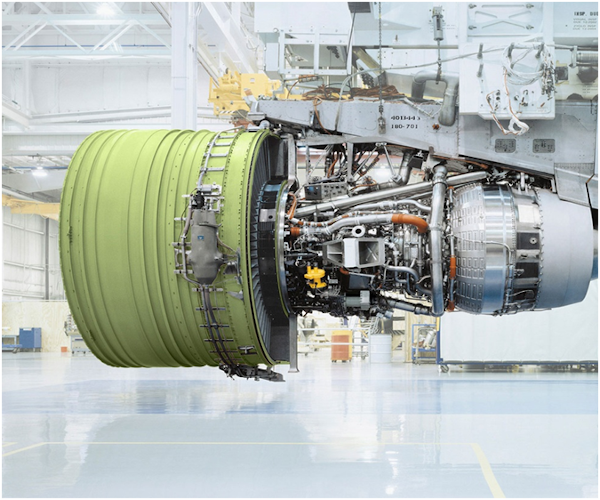

- Commercial Aviation — Although this market segment has suffered greatly due to COVID-19, it did improve margins. Commercial aviation is one of the biggest users of 3D printing technologies. GE’s defense business is not meaningfully impacted by COVID-19.

- Renewables — Here, the onshore and offshore wind business had positive trends and this is another business with 3D printing applications and excellent global growth opportunities. In a Bloomberg interview, CEO Larry Culp stated that GE is benefiting from the continuing global trend away from coal and nuclear power to renewables.

- Power — GE has a major turbine segment; we have previously written a Fabbaloo article that explains the 3D printing opportunities with turbines.

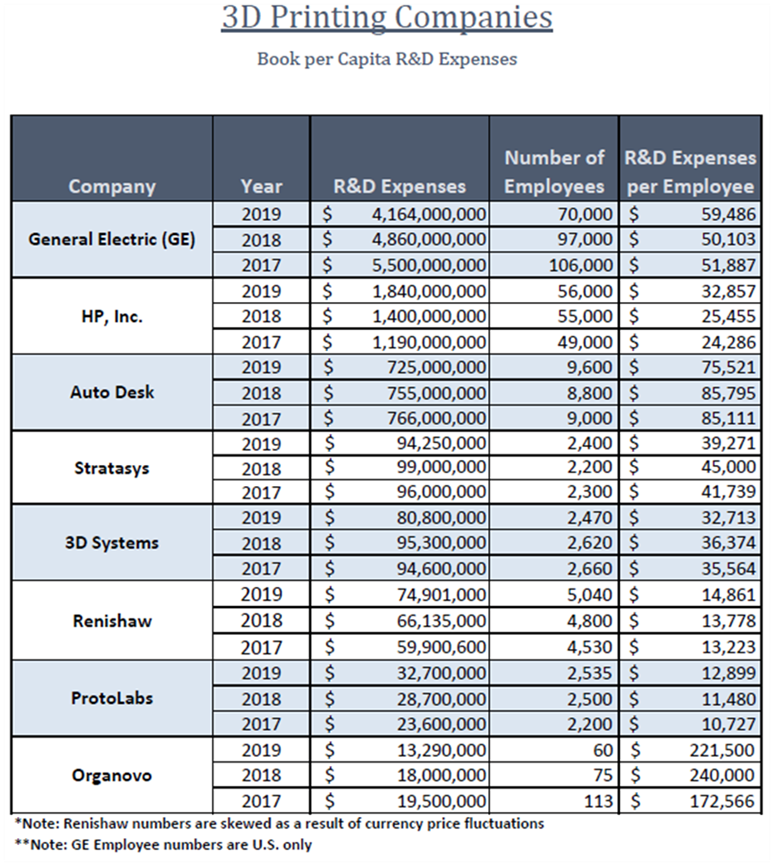

GE still maintains one of the industrial business sector’s largest R&D budgets which is presented below:

In their third quarter press release, GE stated that they remain committed to transformative R&D investments.

Federal tax incentives, such as the Research and Development Tax Credit, are available for companies that pursue 3D printing activities.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

GE is still one of the country’s major industrial companies and has made one of the largest commitments to 3D printing. If GE can recover sooner than anticipated particularly in the current economy it is good for the U.S. and the 3D printing industry.