Charles R. Goulding and Preeti Sulibhavi explore more about the recent rise of VulcanForms.

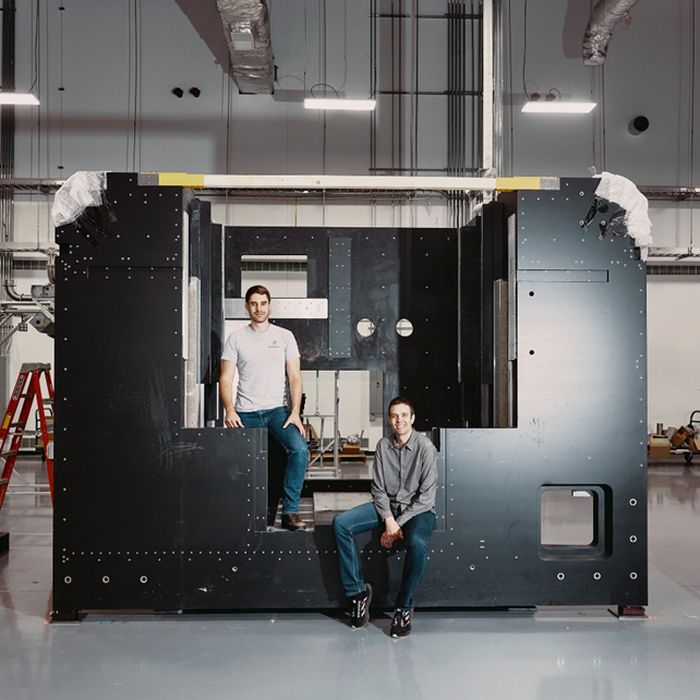

In a perfect 4th of July 2022 news article, the New York Times (NYT) devoted the front page of the business section to Massachusetts-based VulcanForms’ (Vulcan) new industrial 3D printing factory business model. Vulcan is creating a 20-ft high, 60,000-pound machine that incorporates 150 laser beams. The startup has raised US$355M and employs 360 people.

Vulcan’s customers include GE, Pratt & Whitney, Google, and Autodesk. The company will provide 3D printing engineering and services and is not selling these machines. Company management includes additive and manufacturing experts from GE and Pratt & Whitney. The company has completed acquisitions that give it heat treating and machining expertise.

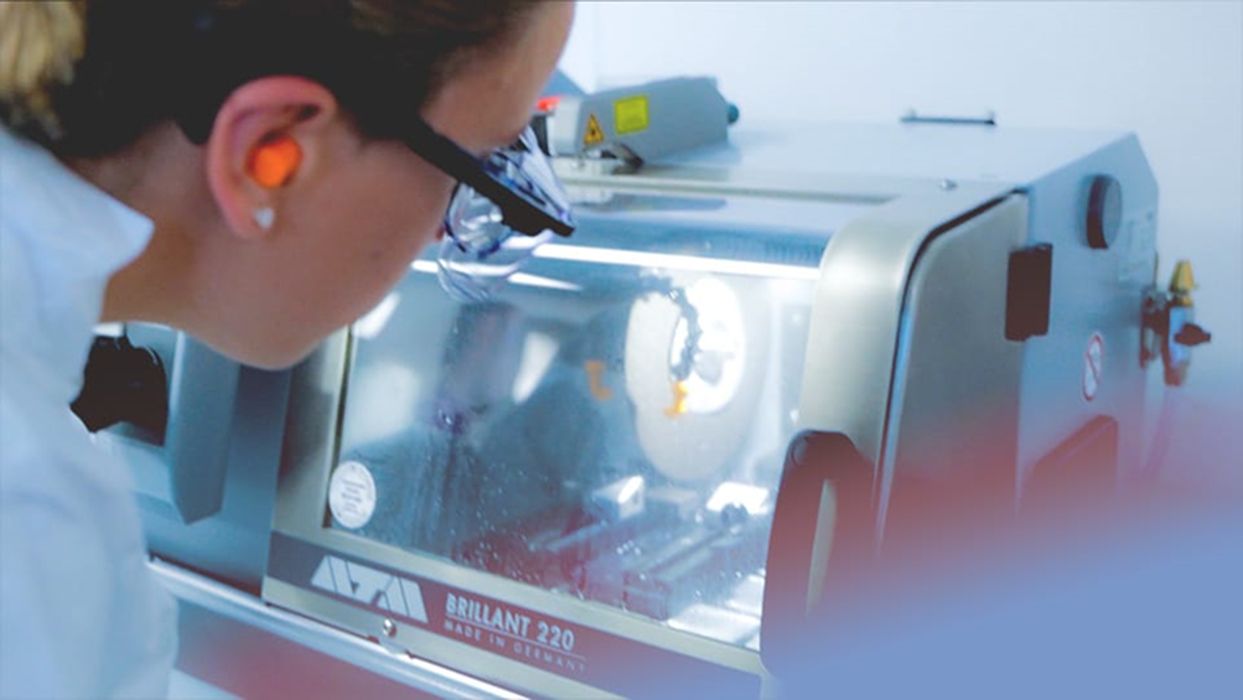

The company’s technology is the result of innovation in laser optics, software and sensors. A customer example used in the article was Cerebras, a semiconductor machine builder for AI applications, which needed design and production of a machine cooling component for data centers.

The Vulcan founders are from MIT and are presented below.

The NYT article does a good job of explaining the history and mainstreaming of the 3D printing industry along with current industry high growth trends. The article also highlights environmental and energy cost reduction advantages as well as a section on the Biden administration’s recent 3D printing initiatives.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

The Vulcan model advances both 3D printing technology and core industrial process improvements. The NYT coverage was a nice 4th of July announcement.