Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

You might think it’s not important to monitor these companies each week, as their value is realized only when stocks are sold. However, events happen to companies occasionally that cause their value to rise and fall, and this weekly post is where we track such things.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s take a look at the 3D printing companies on this week’s list.

3D Printing Leaderboard

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 2547 | -220 |

| 2 | Xometry | 2468 | +191 |

| 3 | Stratasys | 1559 | -44 |

| 4 | Protolabs | 1439 | +23 |

| 5 | Desktop Metal | 1406 | -134 |

| 6 | Materialise | 1283 | -105 |

| 7 | Velo3D | 1143 | -289 |

| 8 | FATHOM | 1109 | NA |

| 9 | Markforged | 1005 | +7 |

| 10 | Nano Dimension | 948 | +2 |

| 11 | SLM Solutions | 417 | -15 |

| 12 | Shapeways | 144 | -35 |

| 13 | Massivit | 118 | -4 |

| 14 | MeaTech 3D | 82 | +1 |

| 15 | Freemelt | 58 | NA |

| 16 | voxeljet | 43 | +1 |

| 17 | Aurora Labs | 13 | +1 |

| 18 | AML3D | 10 | 0 |

| 19 | Tinkerine | 2 | 0 |

| TOTAL | 15794 | +548 |

This week saw several interesting movements. Companies tracked moved up, down and stayed flat; there was something for everyone. Overall, the board saw a gain, but there’s a reason for this that isn’t because company values grew. The greater market was only slightly down, so these movements are likely due to specifics of each company.

Several companies saw notable losses in value. 3D Systems and Desktop Metal dropped about nine percent each, while Velo3D dropped an astonishing 20% in value. Desktop Metal and 3D Systems have bounced around in this manner previously, but neither had any particular news the would warrant this drop — although both suspiciously announced they were to speak at the upcoming Needham Virtual Growth conference. Coincidence?

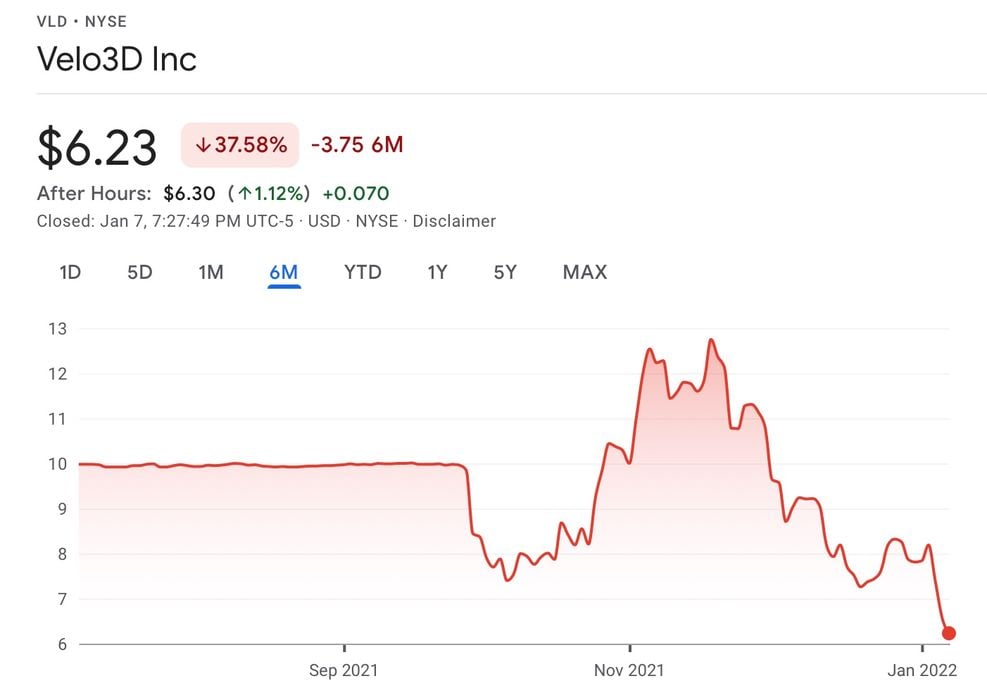

Meanwhile, Velo3D’s drop also was not triggered by any specific announcements from the company. However, the company’s value has been on quite a rollercoaster ride since its appearance on the market back in October, as you can see in this chart.

This week’s shift places the company at its lowest public valuation ever, over 30% lower than it’s initial opening price. While they were once occupying third spot on our leaderboard, they are now down to position seven. Why the drop? It could still be a case of investors struggling to find a stable level. Given the burgeoning interest in use of additive manufacturing, and this company’s capabilities, it could be that Velo3D is currently undervalued.

Shapeways also suffered yet another significant loss in value, almost 20% this week. Similar to Velo3D, this company has dropped in value nearly each week since their debut on the NYSE. However, they’ve dropped an astonishing 76% from their peak value in October. My take is that initial investors were attracted by Shapeways’ well-known reputation in the industry, but later realized that the company has shifted to a more industrial market and face stiff competition from multiple other players.

Was this week all bad news? Not at all. Xometry, currently in position two, actually gained over eight percent over the week. Xometry’s participation in the Needham Virtual Growth conference evidently did not affect their results this week, but it is more likely that their financial results, which were unexpectedly better than estimated, caused the rise in value. Once again, money talks.

The one company on the leaderboard that did something significant this week was Nano Dimension, which acquired an inkjet company. Ironically, that acquisition seems to have had literally zero effect on their value, at least for this week.

There were two additions to our leaderboard this week.

FATHOM is a digital manufacturing service that makes heavy use of 3D print technology. They had previously indicated their intent to appear on the market, and have now debuted. Their value is significant, and ranks them at position eight on the leaderboard. I’m wondering if they will suffer the same rough ride that Shapeways and Velo3D have undergone.

Another addition is Freemelt, a Swedish company I’ve recently realized is also publicly traded. They produce a very interesting small metal 3D printer designed for materials research, and have recently partnered with 6K Additive to develop new metal materials.

While our total for the week went up, that gain was largely due to the addition of the two new entrants. Otherwise, we would have seen a loss for the week.

Upcoming Changes

We are still awaiting the appearance on the market of one more 3D print company: Fast Radius, a digital manufacturing cloud service.

Another company set to appear in early 2022 is Essentium, who announced plans to use a SPAC-merger to launch on NASDAQ.

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t know exactly what it is at any moment. The suspected bigger companies include EOS, Carbon, Formlabs and SLM Solutions.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.