Charles R. Goulding reflects on “The Secret History of Home Economics” and the history of trailblazing women making an impact in science and technology.

For women who have attended leading universities with strong science programs like Massachusetts Institute of Technology (MIT), Drexel, Kansas State, Iowa State, Howard University and Cornell, you may be surprised to learn about the herculean efforts made by prior generations of women who paved the way. But not in the way you might think.

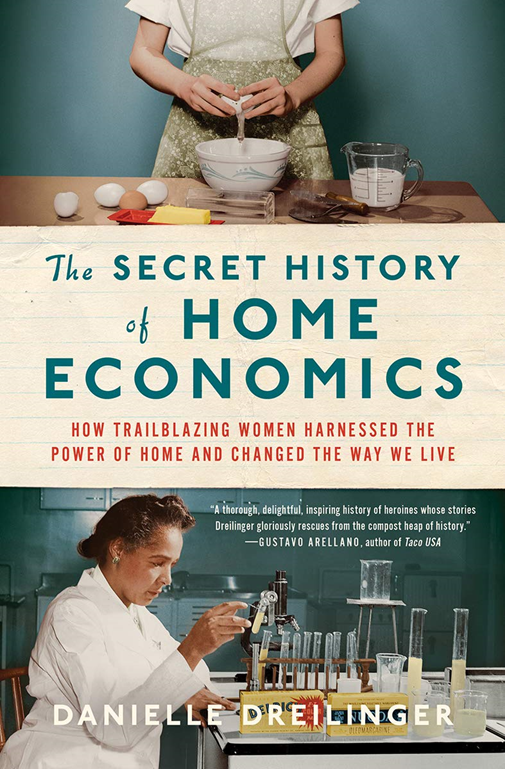

In her new book, “The Secret History of Home Economics,” author Danielle Dreilinger explains how the home economics course of study provided the entry for women into science. Contrary to some misconceptions about home economics for women, it provided an entry into the study of numerous technical areas including chemistry, nutrition, refrigeration, ventilation, textiles, electricity and kitchen design including improved appliances.

Some of the leading women covered in the book that led the home economics-to-science conversion included, Catharine Beecher, Ellen Swallow Richards, Margaret Murray Washington, Lillian Moller Gilbreth, Martha Van Rensselaer, Flemmie Pansy Kittrell, Flora Rose and Eleanor Roosevelt.

Ellen Swallow Richards was a Vassar graduate, chemist, and sanitary engineer, and the first woman to attend and obtain a degree from MIT.

Lilly Gilbreth obtained a PhD and, upon her husband’s death, converted what had been her and her husband’s joint interest in industrial engineering to home engineering. She secured clients such as GE and Johnson & Johnson. The Gilbreths’ life was made famous in the movie, “Cheaper by the Dozen,” which we featured in a previous article.

Having worked for two Fortune 500 engineering-based, industrial companies for almost 30 years, I have always been impressed with women that have been able to excel in technological environments. Women like Marye Barra at GM, Carly Fiorina, formerly of Hewlett Packard, Meg Whitman, formerly of eBay, and Carol Bartz, formerly of Autodesk, readily come to mind. Danielle Dreilinger’s book filled the historical gap in my knowledge and presents many trailblazing women that led the way for today’s generation of women.

Many women are involved throughout the 3D printing industry, continuing to blaze trails and make important business decisions.

The Research & Development Tax Credit

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The days when home economics class meant making silver dollar pancakes or learning to use a sewing machine might be gone, but surprisingly, the lessons learnt from such unassuming classes are evident in many of today’s industrial sectors. For the women mentioned, to take their home economics lessons and pave the way into technological and engineering-based industries for future women is quite remarkable.