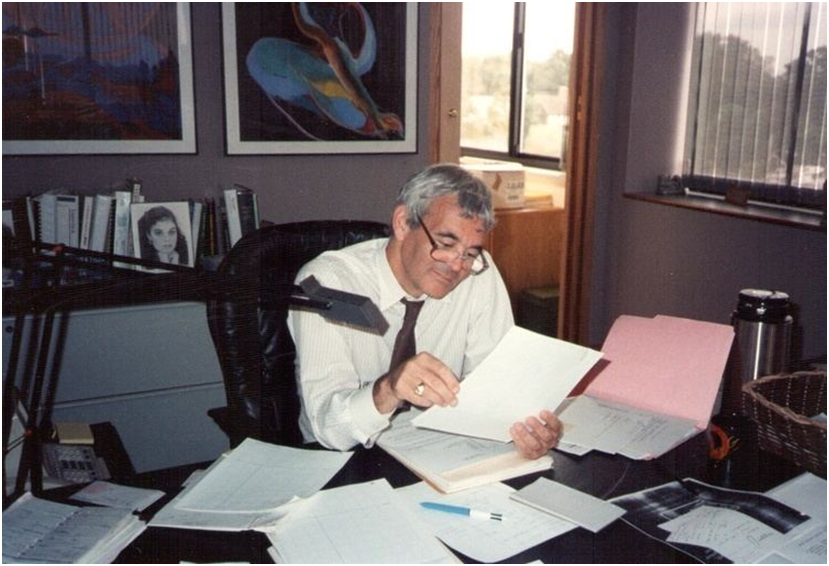

Charles R. Goulding and Preeti Sulibhavi consider the 3D printing legacy of the late Gideon Gartner.

On December 12, 2020, Gideon Gartner — who founded the Gartner Group and revolutionized technological research — passed away at the age of 85. Gartner leveraged a background at IBM and leading Wall Street firms to create a world-renowned, hybrid tech-research, marketing and advertising firm with a particular focus on computer technology. Gartner had both undergraduate and graduate degrees from Massachusetts Institute of Technology (MIT).

Gartner personally embodied the scientific management theories of Fredrick Taylor and Frank Gilbreth. Taylor was focused on theories related to time, while Gilbreth’s specialty was more on motion. Frank Gilbreth and his wife, Lillian, were portrayed in the movie “Cheaper by the Dozen.” Gartner then created personal processes to fast shave with 12 razor strokes and take a shower in 10 seconds.

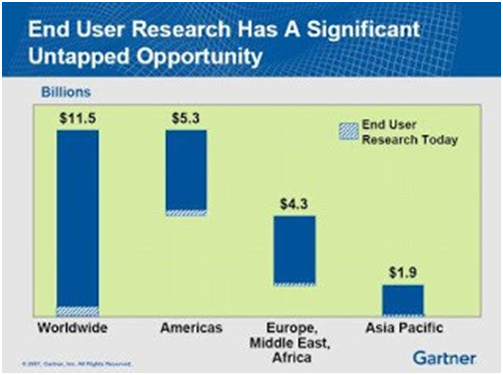

Gartner famously said, “if you don’t have something controversial to say, don’t say it.” After Gartner sold the Gartner Group, the company created the famous technology “hype cycle.” Although I personally don’t like the name “hype cycle,” the Gartner Group annually presented the emerging 3D printing sector for the powerhouse industry we know it to be today.

A detailed list of the 2019 Gartner Group 3D printing hype cycle topics is presented below:

On the Rise

- 3D Printing With Bound Materials

- Blockchain in 3D Printing

- 3D Printing of Consumable Personal Products

- Nanoscale 3D Printing

- 3D Printing Workflow Software

- 3D Bioprinted Organ Transplants

- 4D Printing

- 3D Printed Wearables

- Generative Design

- Managed 3D Print Services

At the Peak

- Sheet Lamination

- IP Protection in 3D Printing

- Macro 3D Printing

- 3D Printing in Oil and Gas

- 3D Printed Drugs

Sliding Into the Trough

- 3D Printed Surgical Implants

- 3D Printing in Retail

- Directed Energy Deposition

- Classroom 3D Printing

- 3D Bioprinted Human Tissue

- 3D Bioprinting for Life Science R&D

- 3D Printing in Supply Chain

- Powder Bed Fusion

- 3D Printing of Medical Devices

- Consumer 3D Printing

- 3D Printing in Aerospace and Defense

- 3D Printing in Manufacturing Operations

- 3D Printed Presurgery Anatomical Models

Climbing the Slope

- Printed Electronics

- Stereolithography

- 3D Printed Tooling, Jigs and Fixtures

- Binder Jetting

- 3D Printing of Dental Devices

- Material Jetting

- Enterprise 3D Printing

- 3D Printing in Automotive

Entering the Plateau

- 3D Scanners

- 3D Print Creation Software

- Material Extrusion

- 3D Printing Service Bureaus

Companies engaged in 3D printing activities and similar developments may be eligible for the Research and Development Tax Credit.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Gideon Gartner began by analyzing the computer industry and became a pioneer for analyzing all modern technologies. Today, those of us who make a living analyzing technology trends should appreciate the impact of his legacy.