Charles Goulding and Raymond Kumar of R&D Tax Savers note the deadline for US Federal R&D tax credit claims relating to 3D printing.

3D printing is poised to become an integral component of production in a variety of industries, ranging from traditional manufacturing and food processing to laboratories and architectural design. Reasons for integrating 3D printing include cost-reduction, increased efficiencies, and better methods for prototyping. Startups not only developing 3D printers but also utilizing the technology in operations have a unique opportunity to claim up to $250,000 annual in cash rebates as part of the Federal R&D Tax Credit program. To timely monetize the payroll tax credit, startups must file their 2018 income tax returns by the end of Q1 2019.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayers business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and for the first time, pre-profitable and pre-revenue startup businesses can obtain up to $250,000 per year in payroll taxes and cash rebates.

Startup R&D Tax Credit Cash Rebate

The new federal tax provides immediate benefits for startups. For the first time ever, a qualifying startup can use the credit against up to $250,000 per year in payroll taxes beginning January 1, 2016. With the new startup provision, companies can utilize the credit despite not paying income taxes and regardless of profitability.

Startups filing their 2018 income tax return by the end of Q1 2019 can utilize the credit to offset payroll taxes on their Q2 2019 payroll tax return. Filing the income tax return in Q2 2019 would delay monetization of the payroll tax credit until the filing of the Q3 2019 payroll tax return, and a Q3 filed income tax return would delay monetization until the filing of the Q4 payroll tax return.

Tax Credit Example: An eligible startup company owes $300,000 in payroll taxes and qualifies for $100,000 in R&D Tax Credits. Since the tax credit can now be applied to payroll taxes, the company’s payroll tax liability is reduced to $200,000. Had the company qualified for a credit in excess of $250,000 (the annual cap), that excess credit can be carried to the subsequent year with tax liability.

3D Printer Adoption

The worldwide 3D printing market value is expected to reach $26 billion in 2022, more than double the approximate industry value in 2018. The combination of declining 3D printer costs, technological advances and increased printer capabilities are set to fuel this expected adoption rate in the upcoming years.

3D printing is one of the most popular categories on Kickstarter, with more than 20 companies involved with 3D printing receiving at least $500,000 in pledges, and 10 of the 50 most funded technology products on the website are 3D printing related. To date, more than 200 3D printer projects have been funded on Kickstarter, including notable 3D printers Printrbot, Form 1 and Robo 3D.

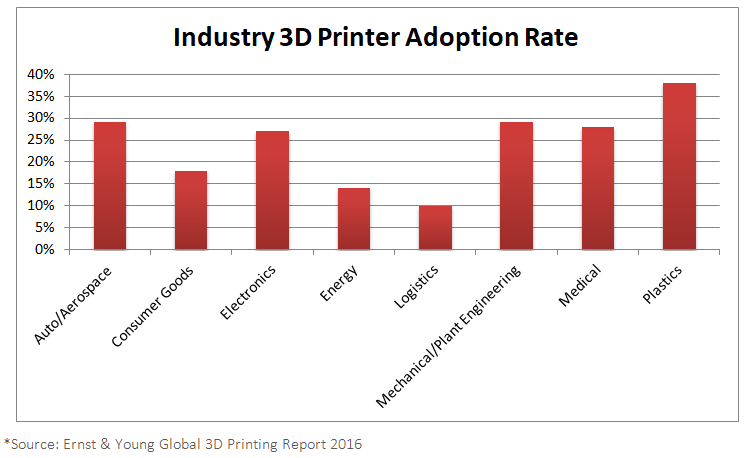

Numerous industries are experiencing transformations due to 3D printing, which allows for cost-effective and efficient developments. The following industries have experienced significant advances due to 3D printing:

-

Architecture – utilizing 3D printers, architects have the capability to develop physical renderings of designed buildings and landscapes in a timely manner. Future applications may involve printing large-scale designs, as several startups have developed homes that can be 3D printed for approximately $10,000.

-

Automotive – the automotive industry has utilized 3D printing to test concepts and develop custom parts. Phoenix-based Local Motors developed the world’s first 3D printed car, the Strati.

-

Medical and Dental – medical providers now have the internal capability to develop 3D models for examination and implants for use in patients. It is belived by many in the medical field that 3D printing organs and tissues will become commonplace in the future.

-

Tools – 3D printers allow for the development of tooling on-demand and customized to specific needs and components. Recently, BMW notably 3D printed assembly production tools that weigh less and improve handling.

-

Toys – 3D printing in the toy industry allows for the development of replacement and interchangeable parts and accessories. It is estimated that the cost of 3D printing toys is 75% lower than traditional manufacturing methods.

Conclusion

Startups involved with manufacturing and operating 3D printers have a unique opportunity to claim up to $250,000 of their R&D Tax Credit against payroll taxes. The window to file is nearing, as startups must file their 2018 income tax returns by the end of Q1 2019 to receive the earliest benefits. The credit can greatly improve the R&D return on investment for these companies.