![[Source: Greer Veon]](https://fabbaloo.com/wp-content/uploads/2020/05/Cimquest-1_img_5eb08dccc0650.png) [Source: Greer Veon]

[Source: Greer Veon]

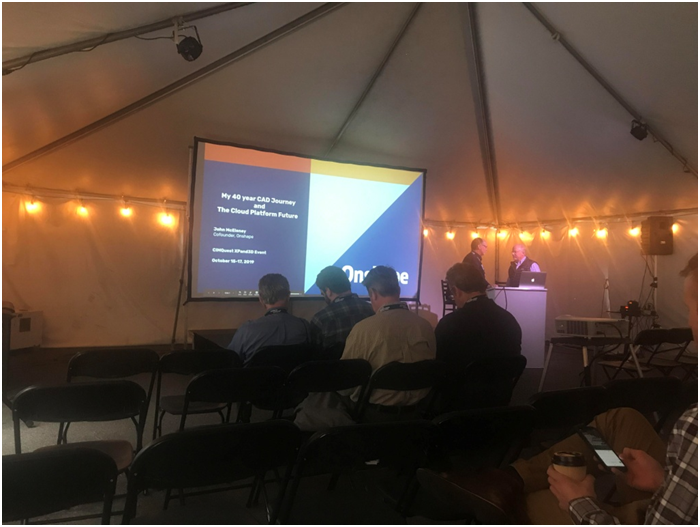

Greer Veon and Preeti Sulibhavi of R&D Tax Savers look back at Cimquest’s Xpand3D Exhibition 2019.

Cimquest’s Xpand3D Exhibition is a leading tradeshow in the 3D printing industry. The conference took place over the course of October 15, 16, and 17, 2019 at the Cimquest Headquarters in Branchburg, New Jersey. Preeti and I had the opportunity to spend the day at the show. The exhibition demonstrates Cimquest’s commitment to education on technological advancements that U.S. companies can employ within the global marketplace.

The exhibition showcased a wide range of industries within the design community. From inspiring keynotes to companies showcasing the latest tool systems, hundreds of attendees represented the premier manufacturer and design expertise in the tri-state area. Numerous exhibitors showed how the latest trends in 3D printing, CAD and CAM software, and machine tools within the market are adapting and changing.

Cimquest holds working relationships with HP, Formlabs, Desktop Metal, and Rize. Showrooms demonstrated these companies’ 3D printers and how the different technologies manufacture prototypes and products that can be used to create parts for various industries, such as automotive and aviation parts.

Xpand3D Exhibition Highlights

![[Source: Greer Veon]](https://fabbaloo.com/wp-content/uploads/2020/05/Cimquest-2_img_5eb08dcd349b2.png) [Source: Greer Veon]

[Source: Greer Veon]

The exhibitors appealed to multiple components within the 3D printing and scanning industry.

Software products introduced ranged from nTopology’s nTop platform for engineers to Paperless Parts’ ITAP-compliant cloud platform for expert quote and order processing. DyeMansion highlighted their ColorsX line that provides a limitless choice of colors for manufacturers through their reproducible dyeing solution.

The tradeshow also brought industry leaders ranging from HP to Nexa3D as keynote speakers for inspiring discussion on innovation and industry opportunities.

Those who sat in asked questions and were able to listen to the perspectives of founders, vice presidents, and program managers and ask questions on where they see the 3D printing industry growing. We listened to Ric Fulop, CEO of Desktop Metal, discuss how the advancements in metal 3D printing technologies allow engineers and designers to create prototypes at a fraction of the time and cost, as well as John McEleney’s discussion regarding his 40-year journey in CAD software and the software he’s created with his company, Onshape (see our recent Fabbaloo article on the cloud-based platform here).

Networking also created a sense of community within the area.

Attendees met those in other niches of the 3D printing industry to form new contacts. Xpand3D considered each perspective within the entire 3D printing process, from innovation to designing a prototype and eventually streamlining a product into the market. The exhibition valued creating a space where insightful, thought-provoking discussions could work to advance the 3D printing landscape.

![[Source: Greer Veon]](https://fabbaloo.com/wp-content/uploads/2020/05/Cimquest-3_img_5eb08dcd887c0.png) [Source: Greer Veon]

[Source: Greer Veon]

The science behind 3D printing and the design process makes companies that invest in the technology eligible for the R&D tax credit.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below US$50MM and, startup businesses can obtain up to US$250,000 per year in payroll tax cash rebates.

Conclusion

The Xpand3D event created an informative picture of the various companies and advancements within the design community. We wanted to highlight the educational foundation of the event provided insight for engineers and production specialists to learn and consider advancements for the future of 3D printing.