![Making parts [Source: Sigma Labs]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb0509971009.jpg)

Charles Goulding and Peter Favata examine how two of Boeing’s suppliers could make increased use of 3D printing technology.

Two Giants in Manufacturing

Two of Boeing’s major suppliers are merging together in a US$6.4B deal consisting of the two publicly traded companies, Woodward and Hexcel. The two companies believe that together they can make greater advancements in fuel efficiency and performance. Woodward which was founded in 1870 and has 9,000 employees is the world’s largest independent designer/manufacturer of control systems parts for aircraft. Hexcel founded in 1948 and has 6,260 employees is also a big player in the aerospace parts industry working with Boeing and Airbus.

3D Printing in Boeing’s Future?

Both Hexcel and Woodward have experience in 3D printing aerospace parts. Hexcel is already on Boeing’s qualified provider list for 3D printed aircraft components, printing parts from their high-performance thermoplastic HexPEDD. These parts provide strong mechanical performance and a significant weight reduction.

![Sample metal 3D prints [Source: Sigma Labs]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb05099cb135.jpg)

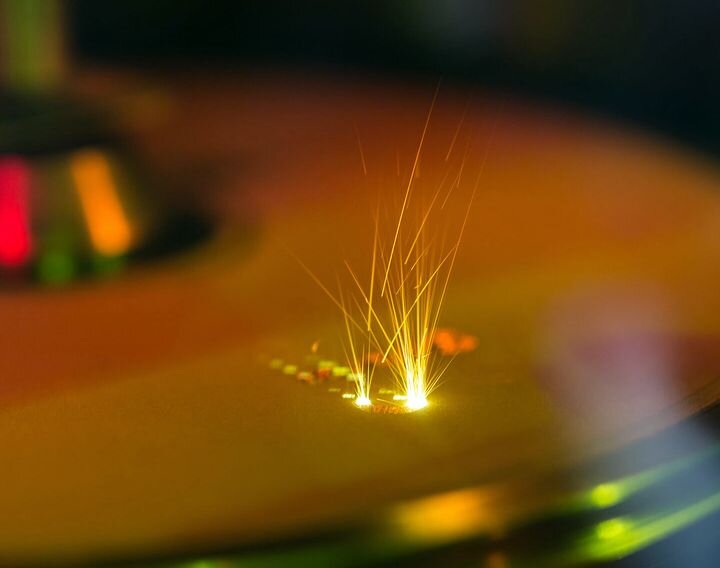

Woodward also has a partnership with Sigma Labs creating 3D printed parts since 2017. This partnership has been working on perfecting 3D printing metal parts for some time now and with the addition of Hexcel’s resources and experience could mean big things for both companies.

Companies that engage in 3D printing aerospace parts may be eligible for the R&D tax credit.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied directly to payroll taxes.

Conclusion

This merger of two companies that both have 3D printing experience combined with Boeing having some recent trouble manufacturing planes; this could mean more 3D printed parts for Boeing planes in the future.