Charles R. Goulding and Preeti Sulibhavi consider how a new treaty focused on areas with a major 3D printing presence may impact trade.

On September 15, 2020, Israel entered into a treaty agreement with two Gulf Arab states, Bahrain and the United Arab Emirates (UAE). The historic deal was brokered by the US, as President Trump congratulated Israel and the Middle East states on “a new dawn of peace.” The UAE is a federation of six emirates: Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al-Quwain, and Fujairah.

Often, when a treaty is signed by contiguous countries, history has shown that trade and business between those countries dramatically improves. The political ramifications of this deal may be apparent, but the trade, business, and sales aspects are still being parsed out.

3D printing should be a part of the trade agreement multiplier effect.

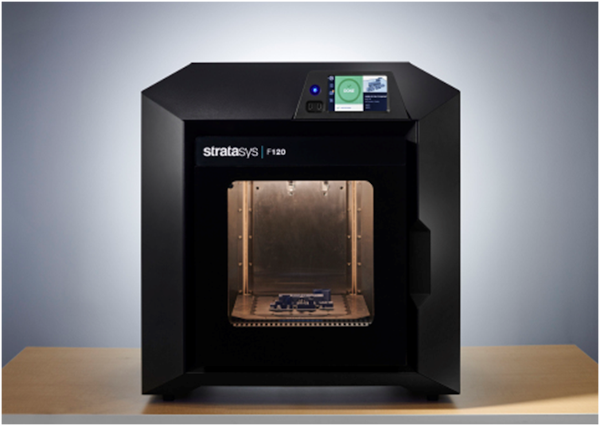

Israel is home to 3D printing pioneer Objet. In 2012, it merged with the American 3D printing leader Stratasys, solidifying its status as one of the largest 3D printing companies on the globe. Now, with dual headquarters in Minnesota and Israel, Stratasys converts digital data into the 3D printed product for clients in a wide range of industries including automotive, consumer products, medical, and the aerospace industry.

Established in 2015, The 3D and Functional Printing Center of Hebrew University in Jerusalem is the first of its kind in Israel. Scientists work on a variety of 3D printing projects finding novel and innovative applications for this technology. From robotics to medical equipment, researchers at the center are pioneers of the industry.

Other notable 3D printing participants in Israel are ceramic and metal 3D printing company XJet and electronics 3D printing company Nano Dimension. Fabbaloo has travelled to Israel to see XJet’s most recently built additive manufacturing center, as well as Nano Dimension’s HQ, for an on-the-ground look at 3D printing in the country. Software company LEO Lane is also based in Israel.

Dubai already has a focus on 3D printing. Examples can be illustrated from their medical industry to their utilities and infrastructure projects. A few years ago, the emirate announced intentions to 3D print 25% of their construction projects by 2030.

With innovative 3D printed products that provide applicable solutions in various industries, it is inevitable that there will be demand. With the Israel – Middle East Treaty, the demand can be met cross-border as well. In that region, this can have a substantial impact on many lives. Outcomes will be positive for the region and can help improve the quality of life through 3D printed medical technologies such as 3D printed organs and other medical tools.

Research and Development tax credits are available for the eligible U.S.-based, 3D printing activities that companies from this area operate business segments in.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The 3D printing community can view this treaty as an opportunity to expand its customers and have a measurable impact on society in the Middle East, especially when Israel and Dubai are already major players in the 3D printing realm.