Charles R. Goulding and Preeti Sulibhavi explore Volkswagen’s $5 billion investment in Rivian, highlighting the game-changing impact on the EV market and the innovative synergy of 3D printing technology.

trade

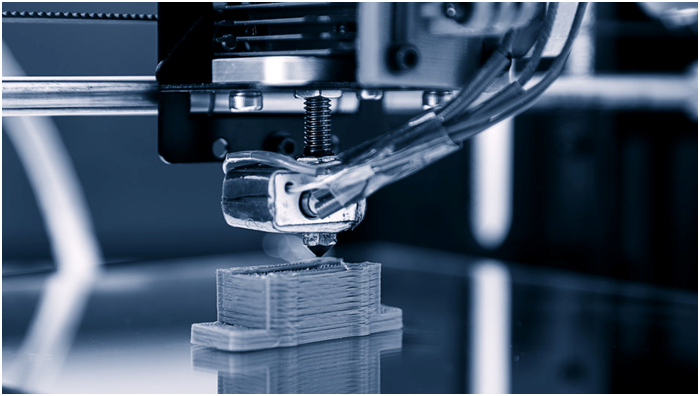

New Trade Policies: Unleashing the Potential of 3D Printing in the U.S.

Charles R. Goulding and Preeti Sulibhavi discover how the latest U.S. tariff policies are driving innovation and growth in the 3D printing industry, reshaping the future of American manufacturing.

India-EFTA Trade Deal Boosts 3D Printing Revolution

Charles R. Goulding and Preeti Sulibhavi explore how the groundbreaking trade deal between India and the EFTA nations is set to revolutionize multiple industries through the strategic implementation of 3D printing technology.

Mexico’s Trade Triumph: A Catalyst for 3D Printing Evolution

Charles R. Goulding and Preeti Sulibhavi examine Mexico overtaking China as the top trade partner of the U.S. and how it can spur 3D printing’s potential.

Backlog on the Rio Grande: How 3D Printing Could Ease Tensions Between the US, Mexico, and Canada

Charles R. Goulding and Preeti Sulibhavi look at manufacturing tensions between three countries.

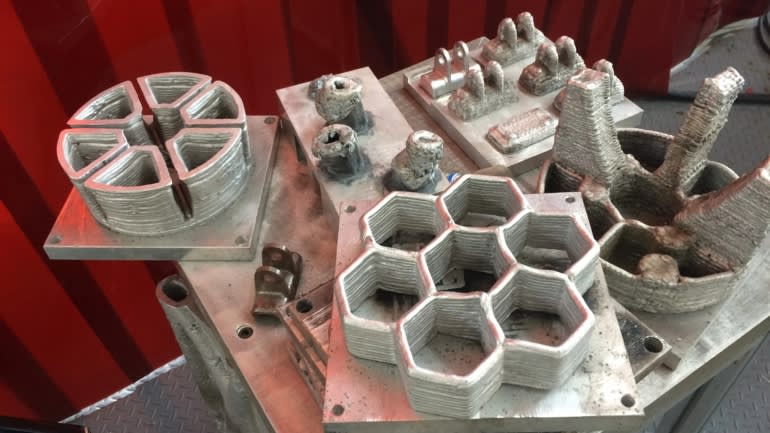

Traps For The Unwary In Launching Additive Manufacturing Globally

Charles R. Goulding invites expert attorney Bob Ward to examine industrial 3D printing impacts from trade laws.

The New Israel–UAE Treaty: Facilitating Trade And 3D Printing

Charles R. Goulding and Preeti Sulibhavi consider how a new treaty focused on areas with a major 3D printing presence may impact trade.

Get Ready for the China versus U.S. Tech Wars

Charles R. Goulding and Preeti Sulibhavi examine the competitive tech landscape in two leading economies.

Realizing 3D Printing’s Opportunities In The Face Of Trade Wars

Global trade and increasing tariffs are major topics of discussion these days — and 3D printing is increasingly a part of that conversation.

What Will No-Deal Brexit Mean For 3D Printing?

The UK leaves the EU on October 31st. What might this mean for companies involved in 3D printing? We look at a long list of issues.

Can 3D Printing Overcome New Tariffs For Overseas Products?

Tariffs have raised the prices of overseas parts. Could 3D printing be used to locally print equivalent parts? We investigate.