Charles R. Goulding and Preeti Sulibhavi take an artistic look at Italian 3D printer use in the country’s latest Renaissance.

Michelangelo’s David is one of Italy’s pieces of classic art that is getting a clean-up. An homage to the Biblical allegory of David vs. Goliath, Michelangelo’s sculpture remains a timeless piece of art. But to remain timeless it must withstand the test of time. The elements and deterioration have had an impact on the sculpture, as is the same with many of Italy’s masterpieces.

Italy, historically known more for its artistry than technology, has taken a different course on restoring its priceless artwork – a digital one. Many famous Italian monuments, including but not limited to Rome’s Colosseum, Michelangelo’s David, and the iconic Spanish Steps, are being restored using the latest technology with help from some of Italy’s leading corporations. With the Italian government facing some challenging debt and cash flow issues, high-end Italian jewelers, fashion houses, and other leading Italian brands have stepped in to help with ongoing clean-up efforts.

Looking for new tools to help facilitate restoration work, Italy’s best and brightest are using 3D scanners and 3D printers to preserve and restore these classic masterpieces from Italy’s Rennaisance age.

In fact, the Massivit 1800 3D printer has been utilized to help restore Balcony Capitals for Spada Palace in Italy. 3D printing is being used often to help preserve and restore historic artifacts, monuments and other objects of work.

Whether it is utilizing additive technologies to manufacture aerospace parts or help fight off COVID-19, Italy has gone all-in with 3D printing.

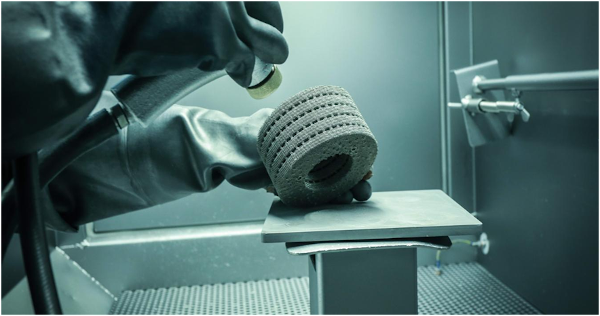

3D printers offer flexibility in the materials that can be utilized. The typical palette of materials used for 3D printing can range in complexity from basic plastics to advanced superalloys. In Cameri, Italy, an Arcam 3D printer is being used to fuse layers of fine metal powder thinner than a human hair to help produce jet engine fuel nozzles.

The combination of substance material and product specifications is something that 3D printing can accomplish effectively.

The demand for face shields in Italy skyrocketed with the onset of the novel coronavirus pandemic. To help serve that demand, Caracol-AM developed an automated 3D printing solution with KUKA robots. The head mounts for face shields are 3D printed at a rate of more than 1,000 per day.

Research and Development Tax Credits are available for the eligible U.S.-based, 3D printing restoration and other manufacturing activities that companies engage in.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

A New Age of Digital Rennaisance

Being world-renowned for artistry does not limit Italy’s vision for its future. As demonstrated in this piece, Italy has entered a new Renaissance – a digital Rennaissance. With help from 3D printers and 3D scanners, Italy will restore its artistic glory of the past while making new masterpieces for the future.