Charles R. Goulding and Alyssa Schneider delve into the use of 3D printing to produce components for generators.

Generators are essential equipment whose main function is to convert mechanical energy into electricity and produce currents. Generators have become critical when experiencing dangerous weather conditions, such as hurricanes and storms, and the power goes out. Generators give that extra back-up set of electricity to keep households and businesses running. The components of electrical generators are a key factor in the mass production of generators.

Some leading manufacturers of generators include:

- ATIMA

- Briggs and Stratton

- Caterpillar (CAT)

- Champion Power Equipment

- Cummins

- Duromax

- Durostar

- Energizer

- Generac

- Kohler

- Westinghouse

- Winco

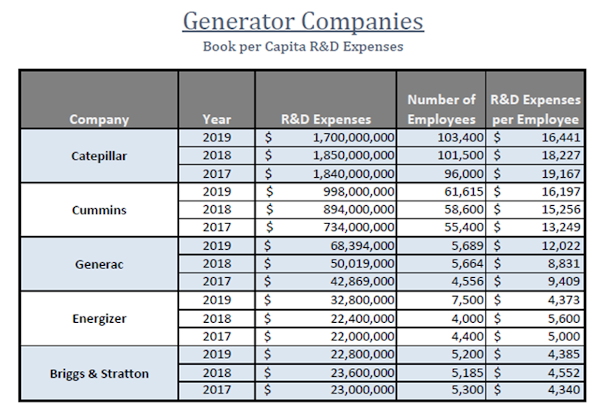

R&D Expenditure for Some of the Leading Generator Manufactures:

Cummins

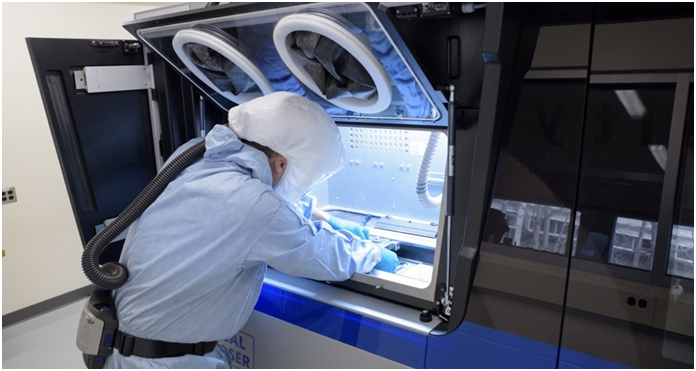

3D printing the components of a generator instead of manually producing them is quicker, easier, and more effective allowing for trial and error and diversity among the components. For instance, Cummins is focusing on 3D printing parts in low volume. One of the many pros of using 3D printing allows for the designer to simply modify the design digitally when encountering any issue that needs changing.

Generac

Generac started using 3D printing to reduce their production time and save resources. Their main issue was that if something went wrong after the redesign of the components, it would be very difficult to rebuild. Generac’s manufacturing process was cut from a few weeks to only a few days with the use of 3D printing and the rebuilding process was much more efficient.

Briggs & Stratton

Our recent article suggests that Briggs & Stratton can positively benefit from 3D printing generator components. Creating and repairing their generators will be much simpler and practical, reducing costs and increasing production time along with durability.

Kohler

Kohler Corporation is a large-scale company with over $7 Billion in revenue and 32,000 global associates. Kohler has long been a key player in the generator industry as they have constantly been at the forefront of innovation. Coupled with Kohler’s KALLISTA division that is dedicated to 3D printing strategies, the boundaries of manufacturing are being pushed which could flow into generator components especially as the company continually reinvents their strategies with enhanced printing methodologies that include unique materials for metal 3D printing.

The Research and Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The generator industry is continuously innovating. 3D printing is increasingly part of that innovation process.