Charles R. Goulding and Arianna Coger offer a perspective on 3D Systems’ apparent shift towards bioprinting.

Last year 3D Systems announced plans to focus on accelerating the adoption of additive manufacturing “in growing markets that demand high-reliability products.” The company has reorganized into two business units concentrated primarily on healthcare and industrial solutions. The healthcare industry has proven to be incredibly profitable and constantly growing as new technology is developed. There are endless applications for additive manufacturing techniques within biomedical/biotech facilities. Several of these applications may include surgical models, medical devices, implants, and lab-grown organs with bioprinting.

Regarding bioprinting, 3D Systems’ President and CEO, Dr. Jeffrey Graves, stated:

“… if you look at the progress we have now made in all of the essential hardware, software and materials elements of bioprinting, we have the opportunity as a company to address a variety of applications within the human body. That’s why we’re increasing our funding and investment and expanding our partnerships to make these applications a reality.”

Since 3D Systems’ restructuring, the prices of their shares have increased by significant percentages compared to previous years, signifying the substantial growth that occurred after their pivot.

3D Systems has acquired multiple biotech companies to help them achieve their long-term goals. 3D Systems’ most recent acquisition of Volumetric Biotechnologies is likely to help accelerate the process of developing improved techniques for 3D printing vasculature. In May, they also announced their acquisition of Allevi, a Pennsylvania-based developer of bioprinting solutions. With this acquisition, they seek to expand the usage of the high in-demand bioprinting technology by improving the performance and scalability 3D bioprinters and bioinks within lab settings.

Along with multiple acquisitions, 3D Systems has begun to sell subsidiaries that no longer align with their new company vision. In July, 3D Systems announced its divestiture of a medical simulation subsidiary, Simbionix, for US$305M to ensure all their funds would solely go towards enabling and expanding additive manufacturing solutions. Regarding this divesture, Dr. Graves of 3D Systems commented:

“The proceeds from this sale, combined with previously announced divestitures, will leave us in a strong position, with a cash balance of approximately $500 million and no debt … we now move forward expecting strong organic growth and profitability, at both a gross margin and EBITDA margin level, and positive operating cash flow capable of sustaining the investments needed to meet increasing customer demand for additive technology.”

On November 8th of this year, the company shared its Q3 results and revealed that they have achieved 36% annual revenue growth compared to 2020 after accounting for the divesture. Overall, the company has exceeded market expectations as they’ve continued to work towards increasing the usage of additive manufacturing in healthcare.

3D Systems has also increased its number of partnerships with biotech companies that participate in 3D printing activities.

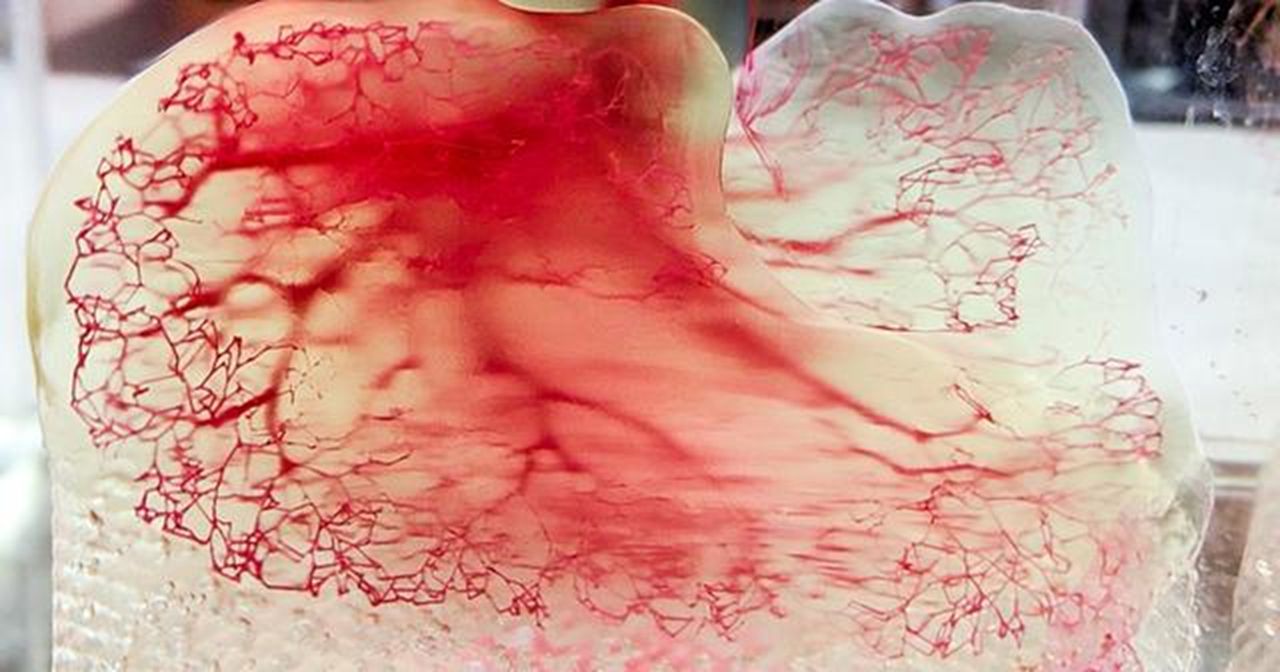

Earlier this year, we discussed 3D Systems’ partnership with CollPlant Biotechnologies to improve breast reconstruction procedures after mastectomies using 3D printing. 3D Systems has also collaborated with United Therapeutics to develop advanced bioprinting technology and processes, resulting in improvements to their “Print to Perfusion” process, which enables the 3D printing of high-resolution scaffolds that can be perfused with living cells to create tissues.

In 2019, 3D Systems collaborated with Antleron, a Belgium-based company, to accelerate the development of regenerative and personalized products for patient care.

Companies taking on similar endeavors may be eligible for Research and Development Tax Credits.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

As of 2016, eligible startup businesses can use the R&D Tax Credit against $250,000 per year in payroll taxes.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

It is clear that 3D Systems will continue to pursue opportunities within the healthcare market to expand its company’s influence and success while accelerating the development of medical solutions. 3D Systems’ additive manufacturing expertise along with the knowledge of experts within the biomedical field are likely to be a recipe for innovation and progress towards finally 3D printing transplantable human organs along and improving personalized medicine.