Charles R. Goulding and Preeti Sulibhavi look at the implications of new legislation in the US.

On September 12th, 2022, the Biden Administration released Executive Order 14081, Advancing Biotechnology and Biomanufacturing Innovation for a Sustainable, Safe and Secure American Bioeconomy. This executive order is intended to harness the power of biotechnology and biomanufacturing towards innovative healthcare, climate change, energy, food security, agriculture, supply chain, and economic solutions.

We have previously covered almost every topic relevant to this new executive order on advancing biotech and biomed fields in the US.

One specific 3D printer that is used in the healthcare industry is the Apium M220 printer. It is the world’s first 3D printer designed solely for manufacturing medical products and implants made out of PEEK, which is a polymer known as “polyether ether ketone.” It is colorless, organic, and achieves the best thermoplastic results out of all in that category.

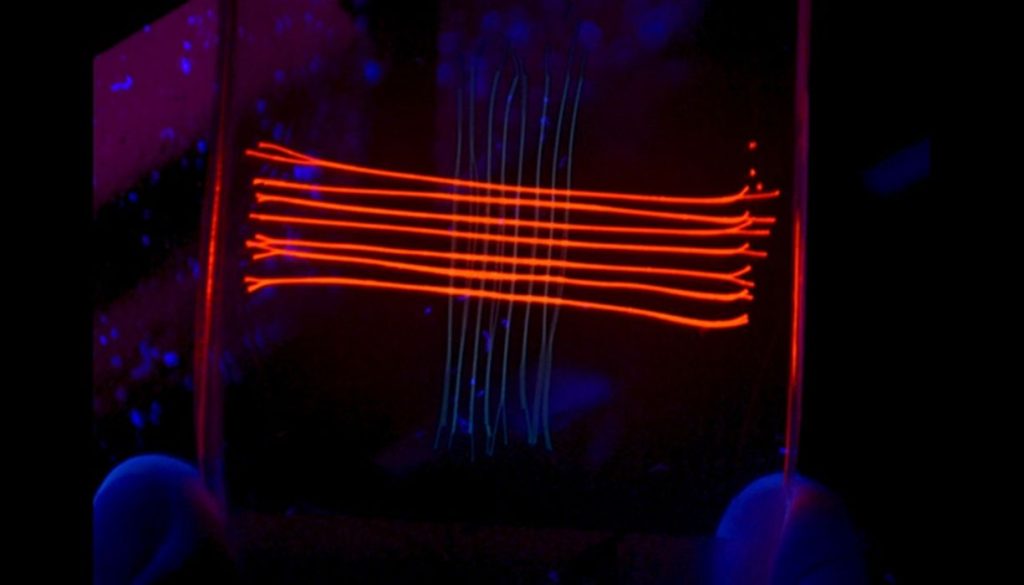

Whether it is painting with platelets or 3D printing optical lenses, there is an opportunity for 3D printing to be a part of this initiative. 3D printing can create bioinks that can be a part of skin grafts and regenerative tissue implants to help patients heal faster.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

There is no better time than now to start ramping up the involvement of the 3D printing industry in the biotech and medtech fields. This executive order is a sign of a seismic shift in US manufacturing toward medical technology.