Charles R. Goulding and Randall Rothbort dig further into 3D printing implications of Biden’s “Buy American” program and Manufacturing Extension Partnerships.

In December 2020, President Biden announced that Jared Bernstein (his Chief Economist and Economic Advisor during his years as vice president) would be joining his Council of Economic Advisors. A noted progressive voice in economics, Bernstein has been a major advocate for workers, and has sat on the Congressional Budget Office’s Advisory Committee as well as been an economic contributor to CNBC, Washington Post, New York Times and various other publications. With this new role, Bernstein once again will have a major role in shaping the nation’s economic and manufacturing future, and a focus on the growth of MEPs (Manufacturing Extension Partnerships) is at the center of it.

After we wrote our recent Fabbaloo article about the Biden Administration’s choice of the nationwide MEP network to implement the new Buy American program, we received multiple inquires. Some of the questions we received included:

- How do I get in touch with my local MEP?

- Why was the MEP network selected?

- Who in the Biden Administration is the policy driver of the new changes?

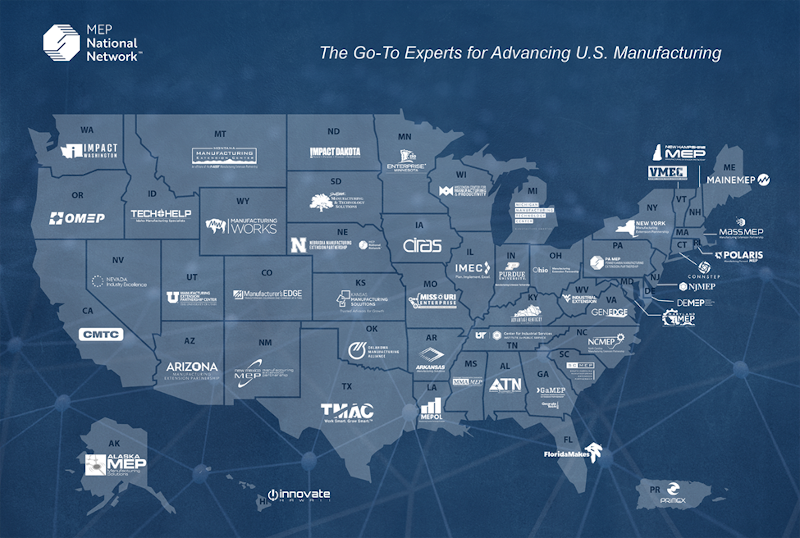

The answer to the first question is straightforward since there is a one-line alphabetical list of each state’s main MEP. We felt that the answers to the other two questions lie in understanding more about the philosophy of Jared Bernstein, Joe Biden’s long-term policy advisor.

What are MEPs?

MEP is the Manufacturing Extension Partnership. This is a program from the US Commerce Department that provides assistance and guidance to small and medium-sized manufacturing firms. Throughout the country, there are many state and regional MEPs that assist local companies with adopting new technologies, integrating into both national and international supply chains, as well as improve regional partnerships. This is a low-cost federal program that has led to large sales increases for many small manufacturing companies throughout the country. MEPs build relationships with many local companies, and often know the best options for all local suppliers and manufacturers. There is also a push by many local MEPs focused in various fields on innovating manufacturing processes.

3D printing is becoming a universally sought-after type of manufacturing, and MEPs work to integrate these 3D printing companies directly into the US supply chain. A standout example for MEPs is NJMEP, which focuses on the New Jersey area and specializes in incorporating manufacturers and suppliers into many fields, most notably medical devices and food. By pairing industries with a need for manufacturing and supplies with innovative suppliers, MEPs can improve business for many small American manufacturers while also giving companies innovative and high-quality materials and supplies. With a 2016 budget of around $130 million, the MEP networked helped 25,000 small and medium-sized manufacturers achieve an increase of about $9.3 billion in sales, $1.4 billion in cost savings, and both the retention of 46,069 jobs as well as the creation of 17,833 new jobs. The MEP, and all subsidiaries, have had demonstrable success, and have shown the ability to improve domestic manufacturing even further.

Who is Jared Bernstein?

Prior to joining Vice President Biden as Chief Economist, Bernstein was deputy chief economist at the labor department, as well as a senior economist and director of the Living Standards Program at the Economic Policy Institute (a non-profit economic think tank based in Washington DC). As a member of the Obama Administration’s economic team, Bernstein had a major impact on bringing the country out of the recession and helped build economic policy throughout the administration. In this new role, he has assisted in the development of various executive orders (such as the “Buy American” executive order that was recently discussed) and will continue to design future economic policy for President Biden.

How is Bernstein utilizing the network?

Throughout the past four years, Bernstein has been critical of manufacturing policies. Manufacturing and supplies for US companies continue to be outsourced to international suppliers due to a combination of foreign manufacturing improvement, and a mismanagement of legislation. The recent administration’s tariffs forced American suppliers to outsource more of their supply from foreign sources. Meanwhile, little to no effort was made on strengthening domestic suppliers and manufacturers, as well as inserting them into the supply chain to replace international sources. Previously, MEPs have expanded American manufacturing, however the recent administration reduced the MEP’s budget from $130 million to just $5 million in 2018, which crippled the MEP network.

Bernstein has long seen MEPs as the most simple and effective method for improving the current domestic manufacturing losses. By supporting the MEP and furthering its inclusion into the American manufacturing landscape, Bernstein sees it as a direct investment in American manufacturing as a whole, and the past successes of the MEP back up this conclusion. By expanding MEP funding, as well as continuing initiatives like the “Buy American” executive order, MEPs across the country can continue to expand their reach, assist small manufacturers and suppliers in integrating into the domestic supply chain, and help to improve the prospects of American manufacturing, all while directly helping American workers in the process. Over the next four years of his involvement with the Biden Administration, Bernstein will likely continue to look for avenues to assist and support MEPs, as well as small American manufacturers and suppliers across the nation.

The Research & Development Tax Credit

Whether it’s used for material production, or for any other manufacturing purpose, 3D printing and similar innovative processes pushed by MEPs are great indicators that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Jared Bernstein is an incredibly well-experienced and progressive voice in the Biden Administration, and his stances on American manufacturing and the MEP network should benefit many small and medium manufacturers, as well as the whole country. As Bernstein continues his work within the administration, expect to see more legislation supporting MEPs and improving the landscape for small, yet innovative, manufacturers across the country.