Charles R. Goulding and Preeti Sulibhavi discuss the potential for additive manufacturing’s role in a manufacturing renaissance.

The US is experiencing an unprecedented surge in investments from foreign companies. Much of this interest can be attributed to the Infrastructure and Investments Jobs Act, the Chips Act and the Inflation Reduction Act (IRA).

The Infrastructure Act earmarked US$1 trillion in funds for infrastructure projects over the next decade. The second includes US$39 billion in funds to promote semiconductor manufacturing in the US (as opposed to outsourcing the manufacturing of this technology that was developed in the US initially). The IRA has set aside US$369 billion in tax credits and other incentives for clean and green energy.

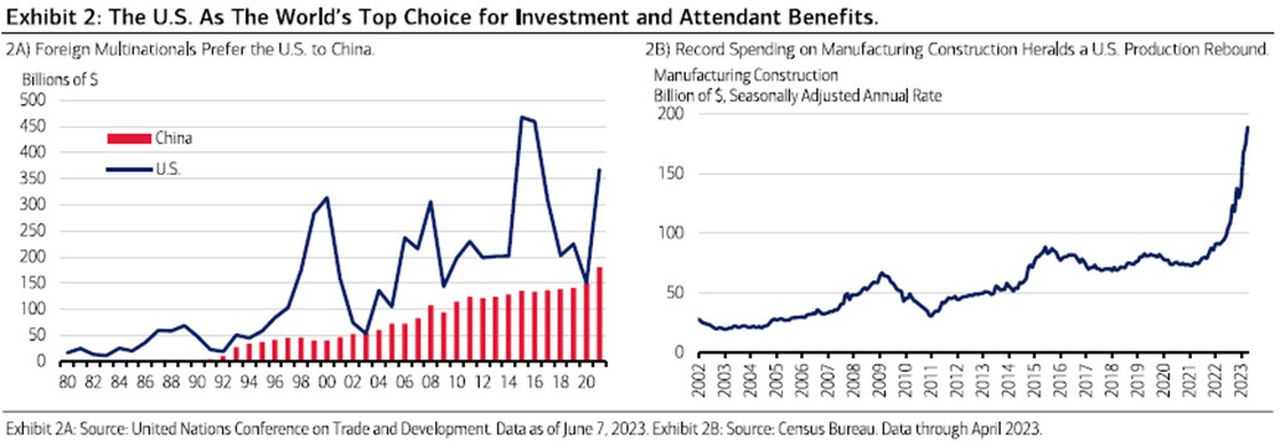

According to Merrill’s June 12th, 2023, Capital Market Outlook by Joseph P. Quinlan, the surge in foreign investments help America emerge as the global leader and redraw supply chains.

According to the report the “legislative trifecta” is going to help America expand its manufacturing base and push it over the cusp of a transformational, manufacturing renaissance.

The rise in foreign investments in the US has led to what many experts are referring to as a manufacturing supercycle.

Manufacturing Supercycle and 3D Printing

The massive new investments are bound to set the economic landscape for the US for years to come. It is predicted that there will be a sustained, upward pressure on demand for workers and raw materials, making a recession less likely by setting a floor of green activities under normally volatile verticals. However, some do predict higher interest rates than in pre-pandemic years.

As of April 2023, spending on new manufacturing construction was approaching a US$189 billion annual rate, triple the average rate in the 2010s (US$63 billion). Hence, the term “manufacturing supercycle.”

Understanding how the manufacturing supercycle will pan out will be critical for understanding the macroeconomy of the remaining 2020s and investing accordingly. The 3D printing industry is already a part of this manufacturing resurgence but can have a greater impact in the following industries.

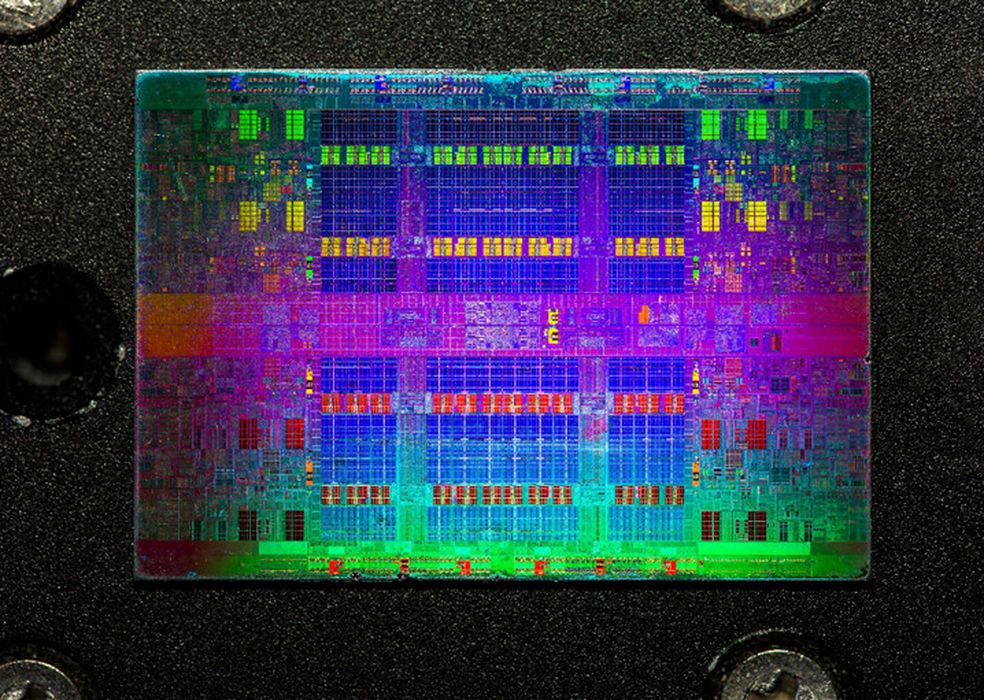

Semiconductors

3D printing is already being used to produce fully functional PCBs with unique geometries, interconnect architectures, and various levels of component embeddings. The ability to 3D print, integrated circuits and other semiconductor devices directly into a PCB allows low-volume fabrication of highly specialized devices with unique form factors and capabilities.

Currently, the most advanced 3D printing technologies provide near micron-level resolution and co-deposition of multiple materials, at a fraction of the cost of traditional manufacturing methods.

Construction and Infrastructure

With increased design freedom, waste reduction, speed and mobility, 3D printers are increasingly being utilized at construction sites across the country. Concrete is increasingly becoming a material for 3D printers such as ICON, CEMEX, COBOD and SIKA that can utilize conventional ready-mix concrete in the printing process.

We have covered how four critical infrastructure companies are moving towards 3D printing and sustainability.

Issues with 3D printing for construction and infrastructure projects mostly have to do with regulations and quality control and consistency. We see this as something that can be addressed successfully by the industry in the coming years.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

There are many reasons to take the manufacturing supercycle seriously. Not just because financial experts are predicting it is a long-term trend, but because of all the positive outcomes that can result from this manufacturing renaissance such as high-tech jobs, cleaner energy solutions and more innovation in the US. The 3D printing industry can ride this “manufacturing supercycle” wave if it hops on now.