Charles R. Goulding and Preeti Sulibhavi review a fascinating recent webinar exploring how recent US legislation affects additive manufacturing.

On January 17th, 2023, the Additive Manufacturing Coalition (AMC) presented a webinar titled, “An Update on the CHIPS Bill Implementation: How AM Can Play a Role.”

We have previously written about the AM Coalition’s webinar series such as: “The Use of Additive Manufacturing in Space: an AM Coalition Webinar,” “The Use of 3D Printing for Repair: an AM Coalition Webinar,” and “The Additive Manufacturing Coalition Webinar and 3D Printing.” But this webinar featured speakers on a semiconductor subject that is extremely relevant this time.

The webinars featured the following speakers from their respective companies/organizations:

- Dr. Kenneth Church, CEO of nScrypt

- Dr. Ahmed A. Busnaina, Distinguished University Professor and Director of the NSF Nanoscale Science and Engineering Center for High-rate Nanomanufacturing Northeastern University

- Ayodele Okeowo, Acting Director of External Affairs, CHIPS for America, Department of Commerce

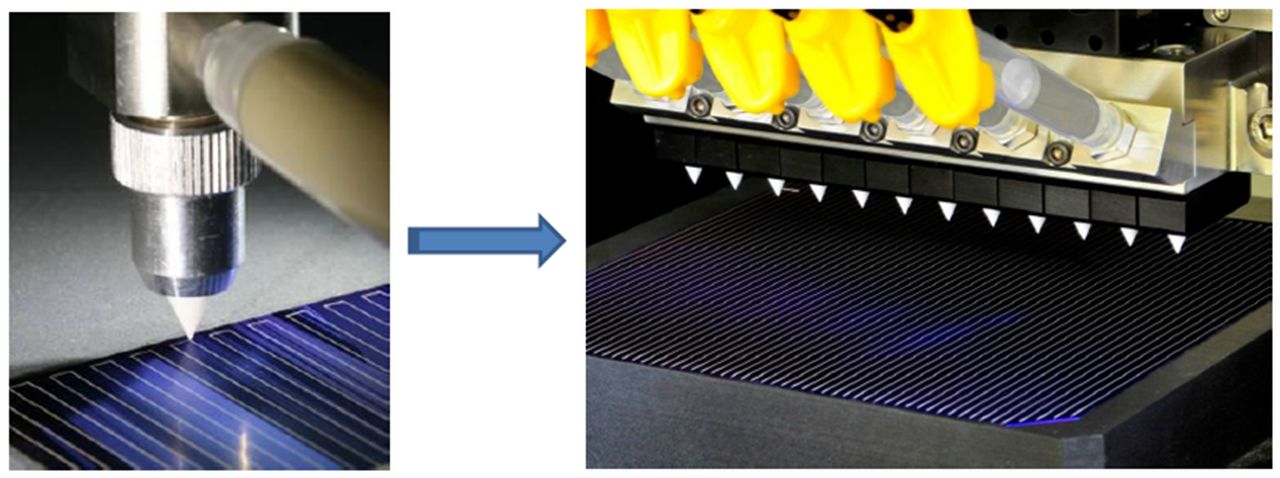

Dr. Church focused on recent advances in 3D printing electronics and how they can help bring semiconductor manufacturing back to the US. For example, he went into how the latest processes have billions of transistors, and with the proper CAD designs, entire circuit boards can be 3D printed directly to bare die or packaged die.

The flexibility means that the materials and shape can be adjusted as needed. According to Dr. Church, the future of chip technology is not limited to flat designs, but rather a plethora of any shapes and sizes.

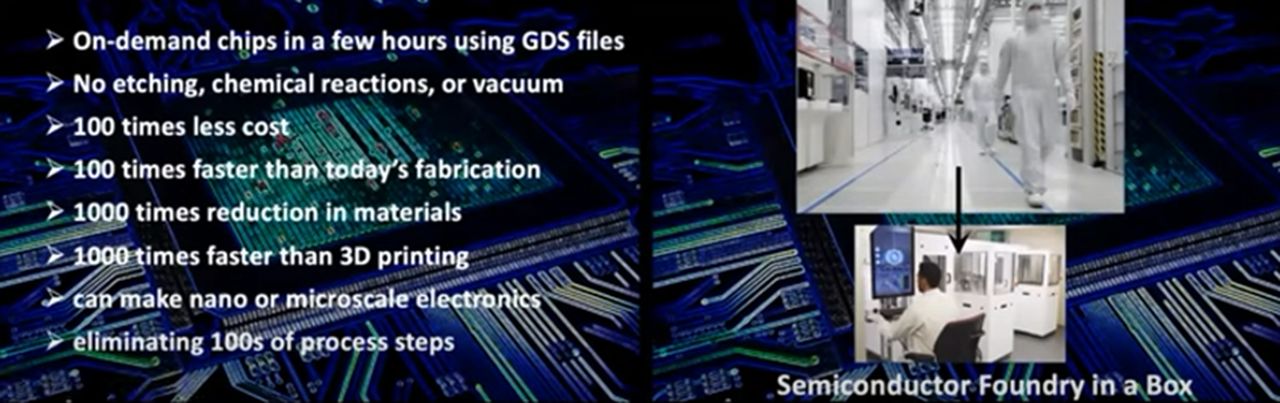

Dr. Busnaina, whose work is funded by the National Science Foundation (NSF) and the Department of Defense (DoD), emphasized the importance of nano-3D printing semiconductors to alleviate supply chain issues as well as to reduce our carbon footprint by about twenty-five times. In addition, nano and using smaller footprint devices that utilize fewer resources reduce chemical waste, landfills, and other environmental hazards.

Dr. Busnaina described how semiconductor foundries involve a multi-step sequence of top-down lithography and bottom-up assembly of molecules that are transported inside special boxes. The 3D printers use MOSFETs to supply high voltage to the heated beds and hot ends. This all can be done using advanced packaging and the use of silicon transistors can further the development of making semiconductor chips in the US.

The diagram below presents the large opportunity potential for nano-scale chip production.

It is interesting to note that both Dr. Church and Dr. Busnaina are graduates of Oklahoma State University.

Mr. Okeowo emphasized the fact that the goal of The CHIPS Act is to strengthen three main things, economic security, national security and future innovation. The CHIPS Act supports all of the 3D printing activities that each of the other speakers is engaged in.

Economic security is strengthening our critical supply chains and reducing exposure to and disruptions from suppliers and dependency on them. National security includes improving defense supply chains and keeping vehicles and equipment in the field in continuous operations. Future innovation is what the seminar is all about.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

As the webinar drove home the importance of securing our future in innovation. America is the country that invented the semiconductor, and, as such, it should remain at the forefront of researching and developing new technologies. The CHIPS Act is intended to do that, including the integration of new 3D printing technologies.