Charles R. Goulding and Preeti Sulibhavi look at Nucor’s potential use of 3D printing technology.

We have previously written about Nucor, America’s leading steel company and 3D printing utilizer. Nucor’s sales were over US$36B in 2021 an 81 percent increase over 2020. Nucor’s tremendous success has enabled the company to go on an acquisition spree and create a vertically integrated business empire. Recent acquisitions have included multiple large scrapyards, which provide a captive source of raw materials. Most recently, Nucor has made a US$3B acquisition of CHI, an overhead garage door company from KKR. We previously wrote on the overhead garage door component shortage and the resulting 3D printing opportunities.

If it chooses to, Nucor can use its 3D printing expertise, including fasteners to do what we suggested for the 3D printing industry to monopolize on the overhead garage door shortage. The CHI acquisition furthers Nucor’s vertical integration of construction industry final product lines.

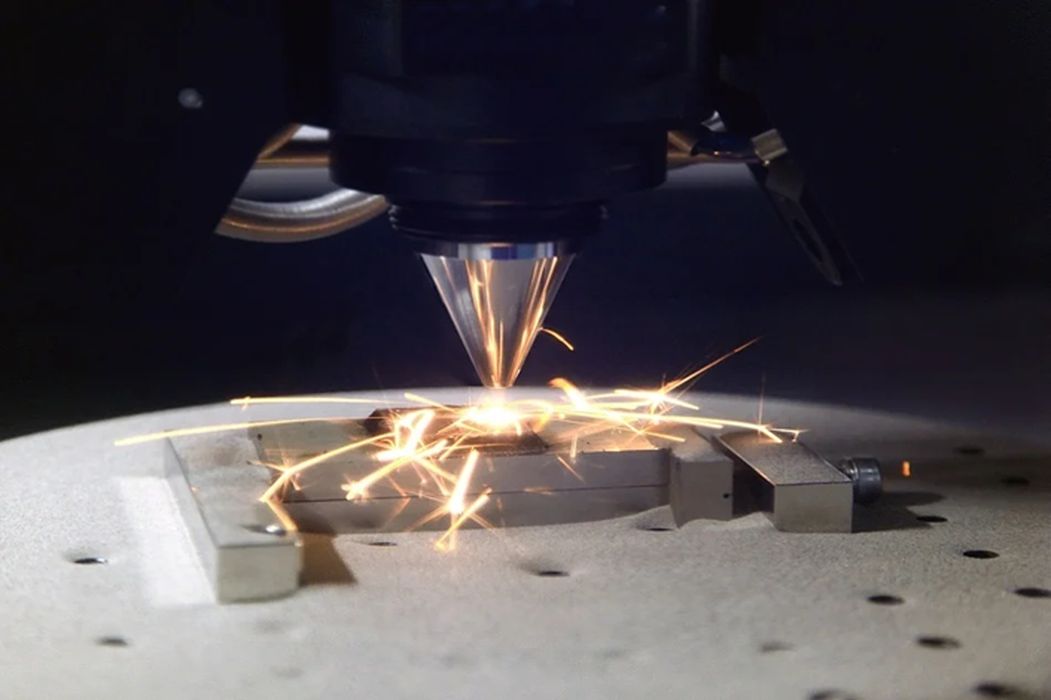

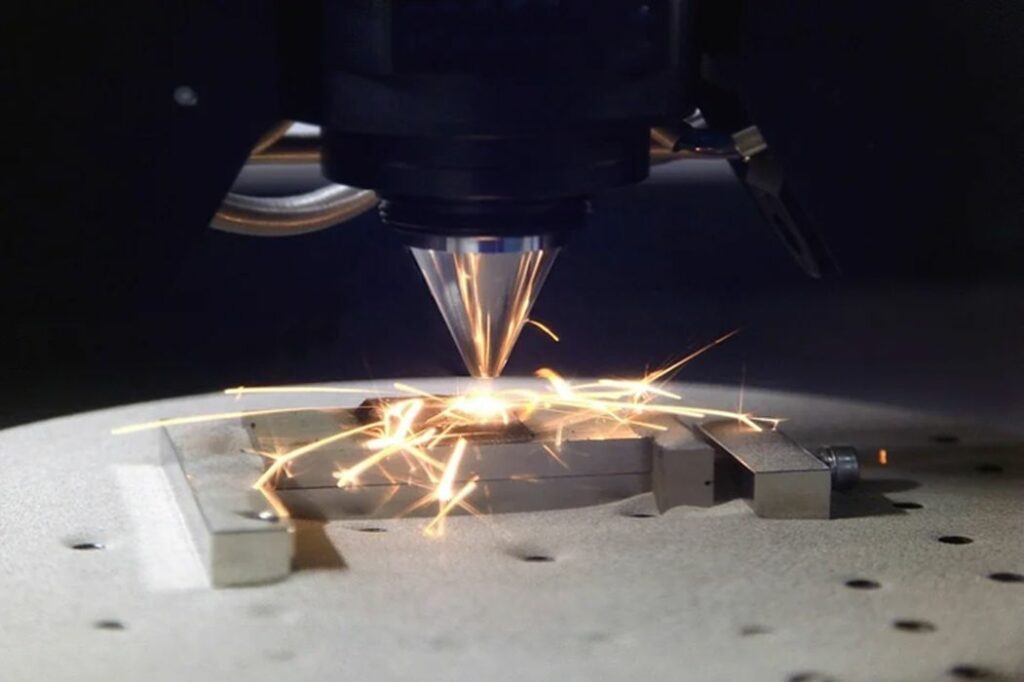

3D printing has advanced a great deal with regards to fabricating metal products. There are various methods of 3D printing metal products. This process involves sintering or melting metal powders directly, or combining them with a second material to allow delivery through a nozzle. It is used for both rapid prototyping and finished production parts for aerospace, mechanical engineering, tooling and more.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

We continue to admire Nucor. It has always been a major recycler and the scrapyard purchases lock in an environmentally positive circular economy. 3D printing has supported Nucor’s final product expansion which can hedge steel commodity price volatility. Job well done.