Charles R. Goulding and Peter Favata take a look at Parker Hannifin’s adoption of additive manufacturing.

Parker Hannifin Corporation, also known as Parker, is an American company focusing on motion and control technologies, pumps, valves, hoses, and aircraft parts. Being that they are primarily a B2B seller of parts and components, they are not very well known to the public.

Parker was founded in Cleveland, Ohio in December of 1964 by Arthur L. Parker. Parker Hannifin has had continued success throughout all these years, with net sales of $13.7 billion a year, 55,000 employees, and a stock price of $237.56 as of the time of writing this article.

Part of the reason they have been able to have this continued success is from adapting to new technologies, including additive manufacturing.

Additive Manufacturing Center

In recent years Parker has opened an additive manufacturing facility with the main purpose of fast-tracking innovation in product design and manufacturing. Parker has stated that this facility “is providing its operating groups and divisions around the world with access to the newest printers, software, and materials available.”

“Material printing technology is moving quickly towards commercial viability,” said Parker’s Craig Maxwell, Vice President – Chief Technology and Innovation Officer upon the 2017 announcement of the center. “The new facility and engineering talent located here represent an investment in the future of manufacturing.”

Utilizing Additive Manufacturing

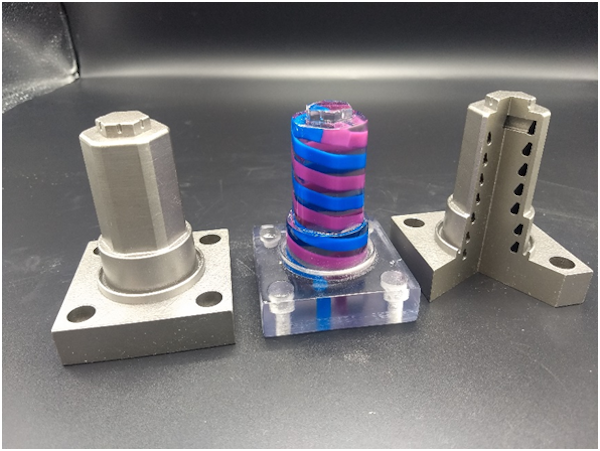

Stratoflex Products, which is a division of Parker, has been using 3D printing for its fluid transfer products. They have been developing a line of products that can be manufactured in lower quantities at much lower costs. Stratoflex also claims these parts will be just as if not more reliable than replacement parts made using traditional manufacturing methods. 3D printing can be used to create a variety of Parker products, including gaskets.

Parker has been using additive manufacturing in the development of prototypes. When designing and testing different pumps, for example, Parker will 3D print clear plastic parts to be assembled to a prototype pump to observe fluid flows and levels. These plastics are weaker than the end product but work great for testing.

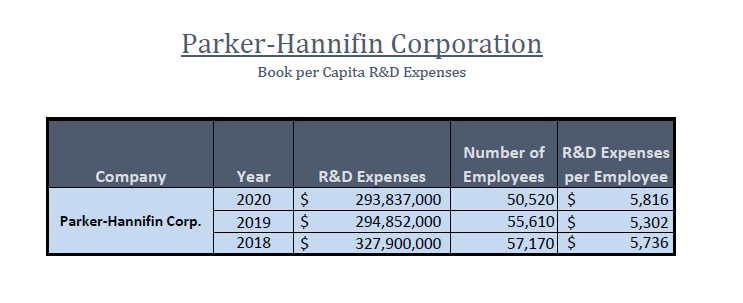

Manufacturers and technical designers utilizing additive manufacturing may be eligible for R&D Tax Credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied directly to payroll taxes.

Conclusion

Parker Hannifin has been producing quality parts for a variety of businesses for many years. 3D printing has become a major part of their company’s ongoing activities. From prototyping to end products, 3D printing has solidified its place in Parker’s manufacturing for years to come.