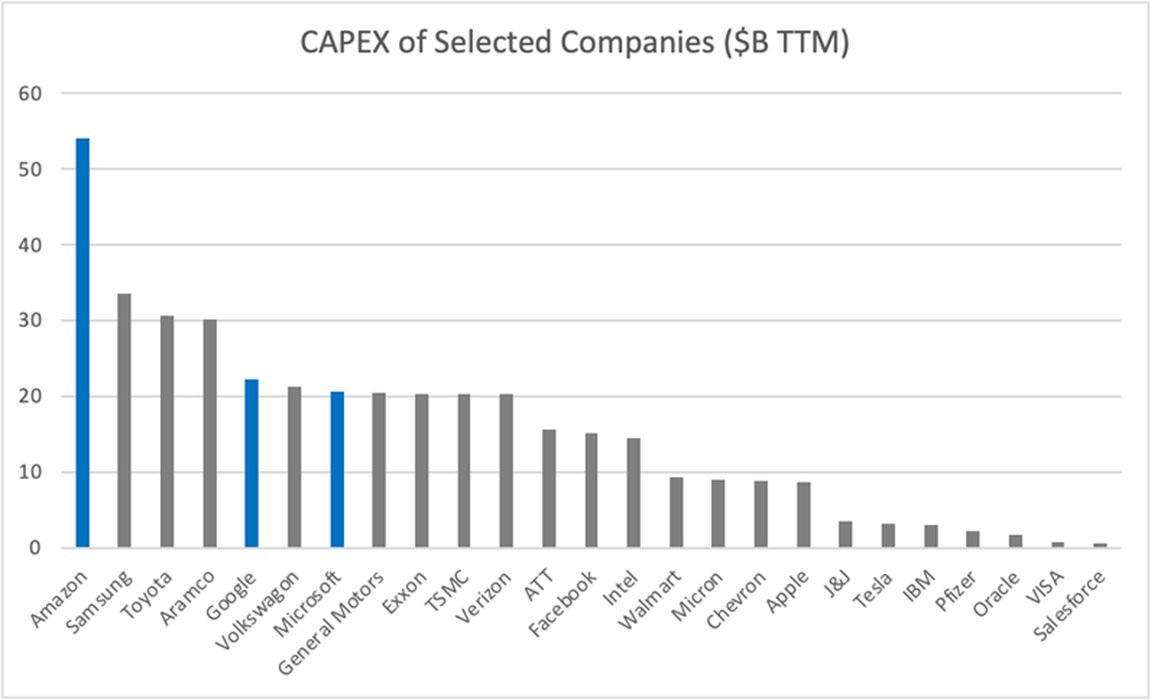

Charles R. Goulding and Preeti Sulibhavi look at how capital expenditures will increase after the pandemic and how they could benefit 3D printing.

Economic history teaches us that CapEx typically increases after a pandemic. The 2022 year is projected to be a major CapEx spending year.

This will be a major change for the 3D printing industry which historically has been overweighted for high volume consumables like dental aligners, sneakers, toys and jewelry.

Some of the major industries’ budgets for CapEx increases, namely energy, semiconductors, automobiles, infrastructure, and aviation, will be discussed below.

Energy

Normally CapEx in the energy sector is to acquire, upgrade and maintain physical assets (i.e., property, plants, buildings, technology, or equipment) to increase the scope of operations and economic benefits in the industry.

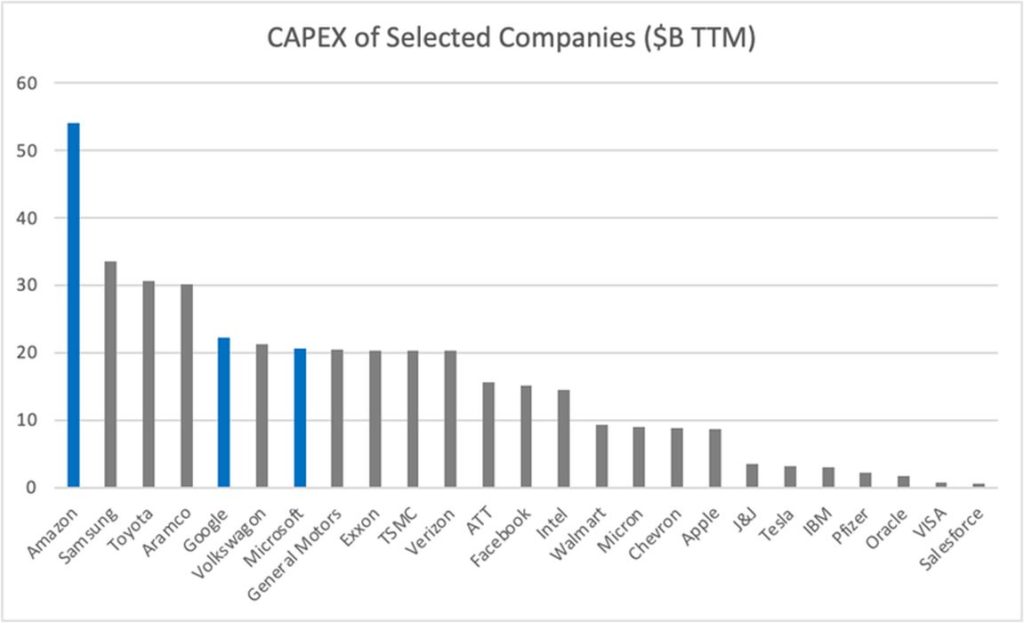

ExxonMobil is poised for the largest spending increase among Western majors. The board is expected to approve a US$20-25B annual CapEx program from 2022 onward.

What’s new at ExxonMobil is that it is making a major commitment to reducing emissions.

Chevron, in its 2022 organic capital and exploratory spending program, proposed a US$15-17B budget range for 2022. Shell’s preliminary budget allotted approximately US$7.2B in capital expenditures for 2022.

Semiconductors

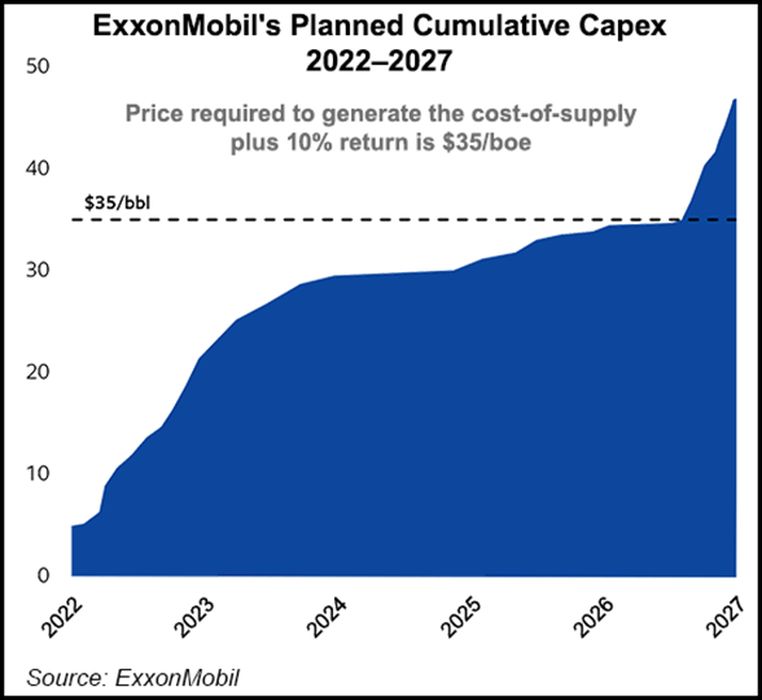

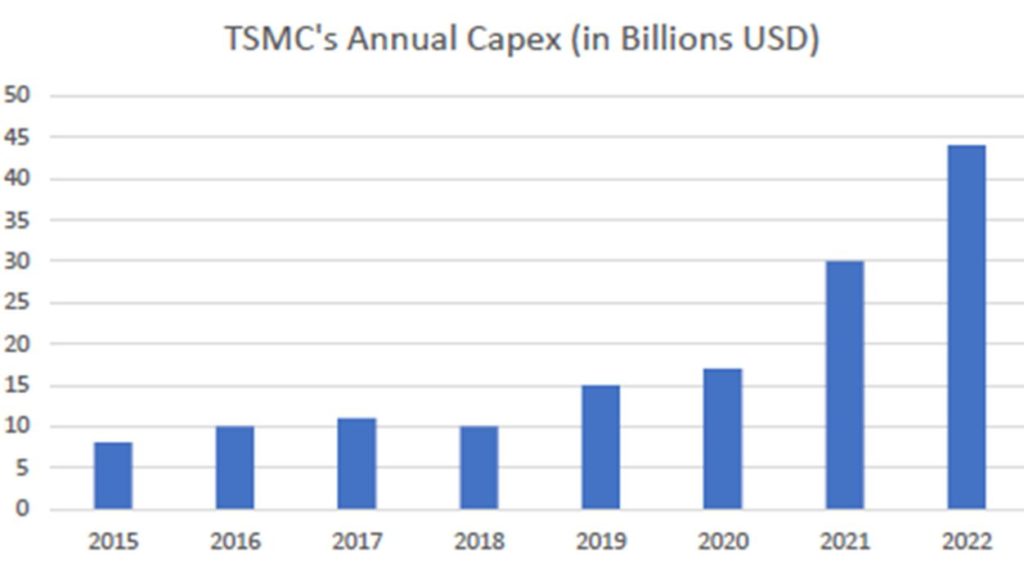

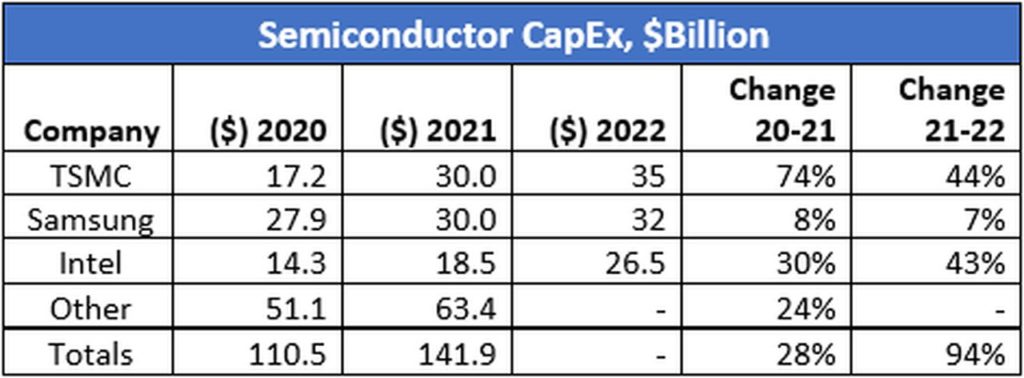

The United States has learned a hard lesson from the current shortage of semiconductors. The automobile and medical device semiconductor shortages have been especially hard. Taiwan Semiconductor (TSMC) is the world’s leading semiconductor manufacturer and they have made a major commitment to increasing their capital expenditures in 2022.

Samsung is another large semiconductor manufacturer and their capital budget increase is presented below. Intel has been investing in both design and is resuming fabrication increasingly.

Intel is building two microprocessor fabrication factories near Columbus, Ohio, with investments of more than US$20B to build these massive plants. The next 10 years will bring eight new foundries, built at a cost of US$100B by Intel, with the hopes of reducing overseas reliance on suppliers for these semiconductor chips. Intel comes in just behind Samsung as one of the largest semiconductor vendors worldwide.

Automobiles

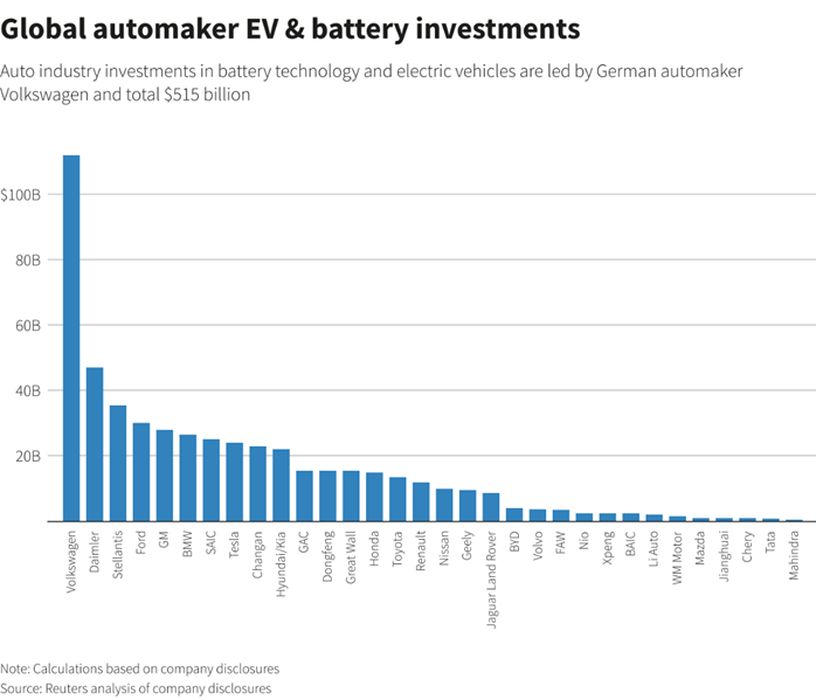

The auto industry has clearly been making investments in electric vehicles (EVs) and driverless cars. There are more electric vehicles on the road now than ever and charging stations will be a necessary part of this changeover.

Infrastructure

There are many reasons to focus on infrastructure. With the recent trillion-dollar infrastructure bill, all eyes are on infrastructure right now. With US$105B allotted to rail, there will be excellent opportunities for 3D printing. Construction industry giants such as Deere and Caterpillar should benefit from the US$126B allocated for roads and bridges in the legislation, as well as new startups offering construction 3D printers.

Aviation

Aviation is a recovering industry since the onset of the pandemic. Delta Airlines, the largest U.S. airline by most financial measures, has increased its 2022 capital expenditure budget to US$6B from less than US$3B. We have written about aerospace supply chain leaders and 3D printing on Fabbaloo before.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

It is good to see the large projected increases in capital expenditures. The existing 3D printing community has not experienced a robust CapEx environment and should have some new opportunities.