Charles R. Goulding and Preeti Sulibhavi examine how the new CHIPS and Science Act could affect 3D printing.

On August 9th, 2022, President Biden signed into law the bipartisan CHIPS and Science Act of 2022, intended to strengthen American manufacturing, supply chains, and national security, as well as invest in research and development, science, and technology. It will potentially position the US to be a leader in various industries including nanotechnology, clean energy, quantum computing, and artificial intelligence (AI).

The Act has motivated industry leaders to announce substantial investments, nearing US$50B, in American semiconductor manufacturing. Micron Technology Inc of Boise, Idaho announced a US$40B investment in memory chip manufacturing, critical for computers and electronic devices, which will create up to 40,000 new jobs in construction and manufacturing. This investment alone will bring the US market share of memory chip production from less than 2% to up to 10% over the next decade.

The CHIPS funding program detail is presented below.

| Amount of Funding ($) | Category of Funding |

| 53,000,000,000 | American semiconductor research, development, manufacturing and workforce development |

| 170,000,000,000 | Scientific research and space exploration |

| 39,000,000,000 | Manufacturing incentives |

| 2,000,000,000 | Legacy chips used in automobiles and defense systems |

| 13,500,000,000 | R&D and workforce development |

| 500,000,000 | Global tech security and supply chain activities |

| 1,700,000,000 | Promoting and deploying wireless technologies |

| 280,000,000,000 | TOTAL |

Since the signing of the CHIPS Act, Qualcomm and GlobalFoundries have announced a new partnership that includes US$4.2B to manufacture chips in an expansion of GlobalFoundries’ upstate New York facility. Qualcomm, the world’s leading fabless semiconductor company, announced plans to increase semiconductor production in the US by up to 50% over the next five years.

On August 8th, 2022, the Malta, New York planning board approved a 633,000-square foot expansion of GlobalFoundries.

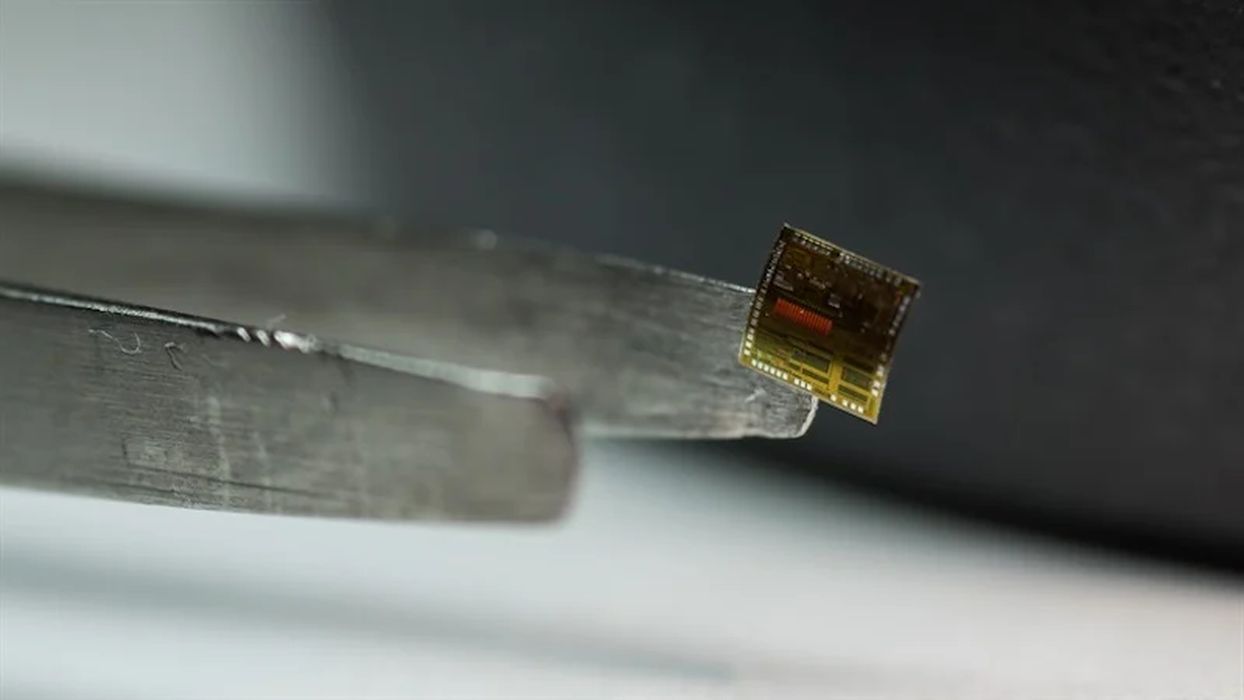

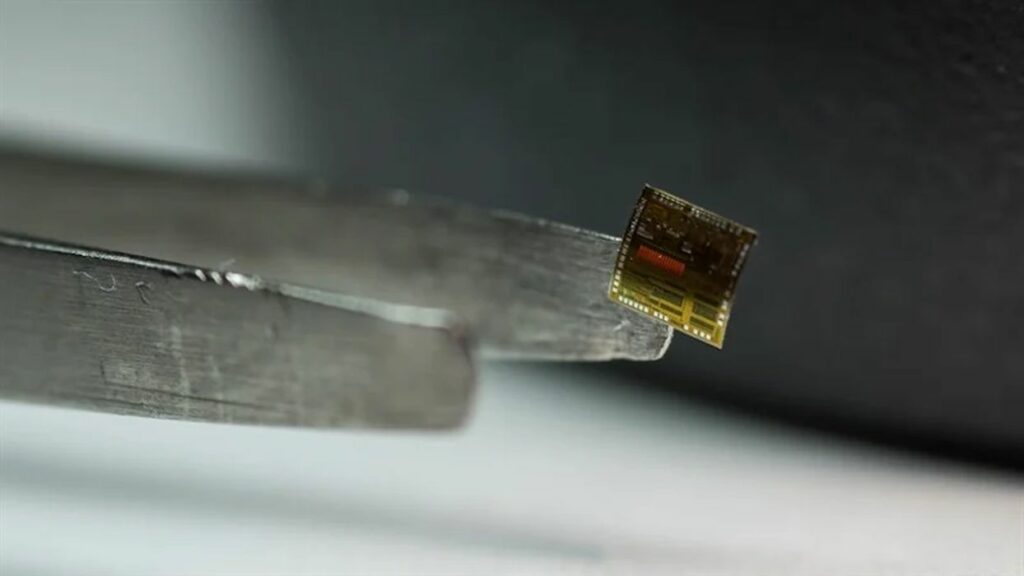

The CHIPS and Science Act will boost American semiconductor research, development, and production, which forms the foundation of everything from automobiles to household appliances to defense systems.

America invented the semiconductor, but today produces about only 10 percent of the world’s supply—and none of the most advanced semiconductors. Instead, we rely on East Asia for 75 percent of global production. The CHIPS and Science Act will unlock hundreds of billions more in private sector semiconductor investment across the country, including production essential to national defense and critical sectors.

We have previously written extensively about semiconductors and how the industry supply chain shortage was affecting everything from automobiles to washing machines. We covered how tensions in Taiwan were pushing many to look at 3D printing for solutions.

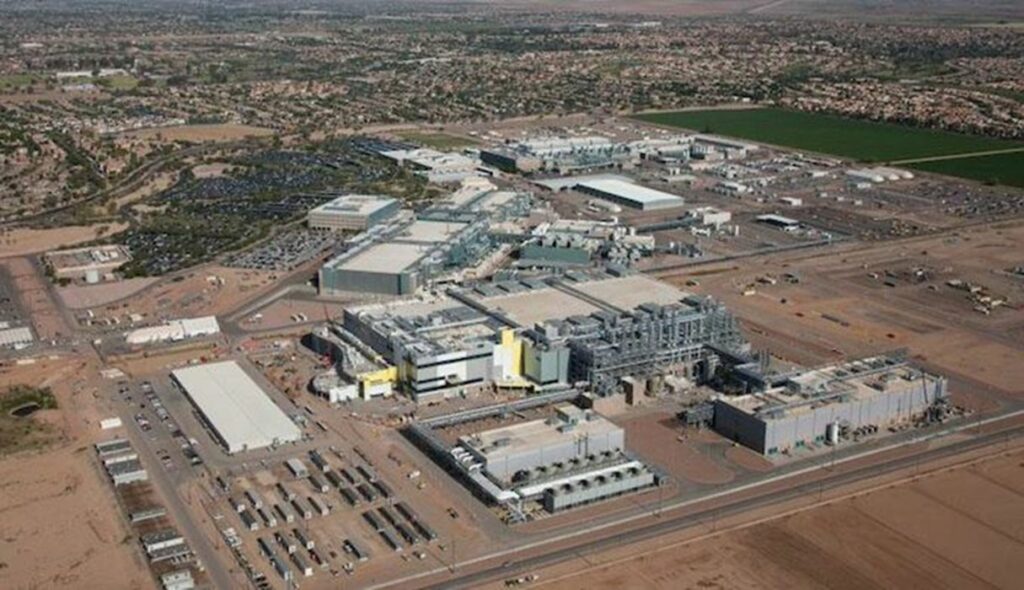

Intel has a deal with Brookfield Asset Management to invest up to US$30B in the new Arizona semiconductor fabrication plant. “Intel benefits via access to $15 billion in capital and Brookfield will share the cash flows of the fabs,” Citi analyst Chris Danely explained, referring to the foundries where chips are created. This transaction has been named the Semiconductor Co-investment Program.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

CHIPS has the potential to leapfrog the US semiconductor industry as well as the economy. The 3D printing industry can be a part of this historic landmark legislation.