Many 3D print companies have “gone public” by entering a stock exchange in the past two years, but which companies might be next?

This may not sound like an important issue to technically-focused Fabbaloo readers, but in the long term it is. When a company becomes publicly traded, that provides the organization with a massive influx of cash, and the ability to more easily raise even more. It’s what they do with that cash that is important.

Companies flush with cash can do several things:

- Perform new research & development to create new forms of 3D printing that are much more advanced

- Develop advertising and sales campaigns and ultimately get many more people 3D printing

- Acquire competitive products and shut them down

- Acquire complementary products and boost them up through integration with their own products

All of these outcomes directly affect the technical world in one way or another. So it’s important to know which companies have gone this way, and which ones will in the future.

Here at Fabbaloo we track the valuations of these public companies in our weekly leaderboard, where we examine the rise and fall of companies as circumstances change from week to week. Years ago there were only two publicly traded 3D print companies, Stratasys and 3D Systems. Now there are well over a dozen, and I have a suspicion there may be more.

Let’s take a look at them. I’ve divided them into three categories for easy inspection.

The Certain Companies

These are companies that absolutely will become publicly traded, and soon. That’s because they have literally announced their intention to do so. Many of them are using a quick method, SPAC, to get tradable, where they are “bought” by a holding company that happens to already be on a market. Just change the names afterwards, and they’re done. No surprises here.

The Suspected Companies

These are companies that in my opinion seem to be positioning themselves for a future public offering. This typically involves securing larger revenue markets, firming up their current investments and solidifying a presence in specific industries.

Additive Industries

Additive Industries produces well-regarded metal additive systems that account for more than just the 3D printing activity. Their recent moves to put in place a new CEO and embark on a business scale up seem right in line with a move to public trading when that scale-up levels off.

BCN3D

The Spanish company has been producing very competent 3D printing equipment for several years. But unlike many of their contemporary competitors, BCN3D has been acquiring companies, gaining new investment and growing their product line in the manufacturing space. All these point to a great position for a future public offering.

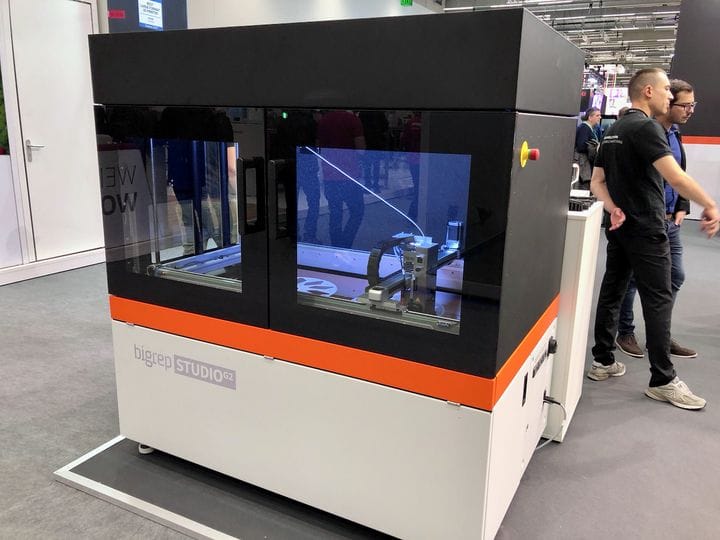

BigRep

The Berlin-based company was the first to exploit the large-format 3D printing market, and they’ve done so quite profitably. They continue to develop important partnerships and have worked deeply into the manufacturing segment, and it would make sense to me to see them become a tradable company.

Carbon

Carbon was the quintessential 3D print startup: invent a new technology, attract massive investment and enable high-profile consumer brands to use their products with advanced software tools. If any of these companies are in a position to go public, Carbon is. My only question is, why haven’t they done so already? They would very likely be at or near the top of our leaderboard.

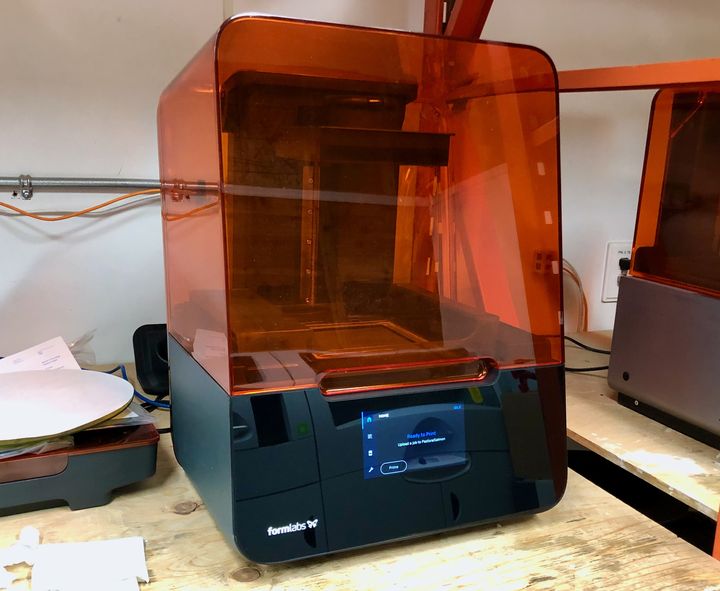

Formlabs

Starting from a Kickstarter project almost a decade ago, the small startup has grown into a massive, global company offering advanced resin 3D printers to multiple industries, including dental and healthcare sectors. They’ve received significant investment in the past from multiple parties, who at some point no doubt wish to get a return on their investment, and that would mean a public offering. If done, Formlabs would be very high on our leaderboard.

nTopology

nTopology produces a highly unusual software tool for generating extremely complex 3D models, and that is precisely the type of object that truly leverages 3D print technology. The industry needs nTopology, and nTopology needs the 3D print industry, and recently they received a very significant private investment. With the greatly increased interest in additive manufacturing and emergence of scalable production-quality equipment, it seems that the company could be set for immense growth. What better way to capitalize on that growth than by going public?

The Not Likely Companies

These are companies that are prominent in the 3D print space, but in my opinion are less likely to become publicly tradable for one reason or another.

Prusa Research

Perhaps the most well-known 3D printer manufacturer in the world, I can’t see them going public anytime soon for a variety of reasons. First, they’ve grown to their current state with a huge proportion of organic growth, meaning they don’t really need massive investment. Secondly, I suspect they may fear a backlash from their long-term, carefully cultivated community that values open source, transparency and similar principles, should they “go corporate”. That’s what happened with MakerBot, so they’ve seen it happen elsewhere.

EOS

EOS, one of the oldest 3D printer manufacturers on the planet, have a massive market around the world and are doing quite well. The company is family owned, and it doesn’t seem to me they would have any interest in going public. They don’t need to, so why do so?

Ultimaker

Ultimaker was launched as a rough startup many years ago, and the company has successfully transformed from one serving DIY hobbyists to today’s choice for big-company professional use. While they could very likely raise a significant amount of money if going public, they don’t seem to have made any moves that hint they are heading that way soon.

And there you have it; companies we might see appear on our weekly 3D print company leaderboard, and those who likely won’t appear.