Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

You might think it’s not important to monitor these companies each week, as their value is realized only when stocks are sold. However, events happen to companies occasionally that cause their value to rise and fall, and this weekly post is where we track such things.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s take a look at the 3D printing companies on this week’s list.

3D Printing Leaderboard

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 2554 | +6 |

| 2 | Xometry | 2414 | -54 |

| 3 | Stratasys | 1574 | +14 |

| 4 | Protolabs | 1388 | -51 |

| 5 | Desktop Metal | 1353 | -53 |

| 6 | Materialise | 1205 | -78 |

| 7 | FATHOM | 1072 | -37 |

| 8 | Velo3D | 1024 | -117 |

| 9 | Nano Dimension | 923 | -25 |

| 10 | Markforged | 911 | -95 |

| 11 | SLM Solutions | 425 | +8 |

| 12 | Shapeways | 121 | -23 |

| 13 | Massivit | 120 | +2 |

| 14 | MeaTech 3D | 84 | +1 |

| 15 | Freemelt | 54 | -4 |

| 16 | voxeljet | 45 | +1 |

| 17 | Aurora Labs | 13 | 0 |

| 18 | AML3D | 10 | 0 |

| 19 | Tinkerine | 2 | 0 |

| TOTAL | 15291 | -503 |

This week saw a very flat week. In fact, the leaderboard moved only three percent, and unfortunately in the downward direction. Most companies saw very modest drops in the single percent ranges.

However, there were some notable swings.

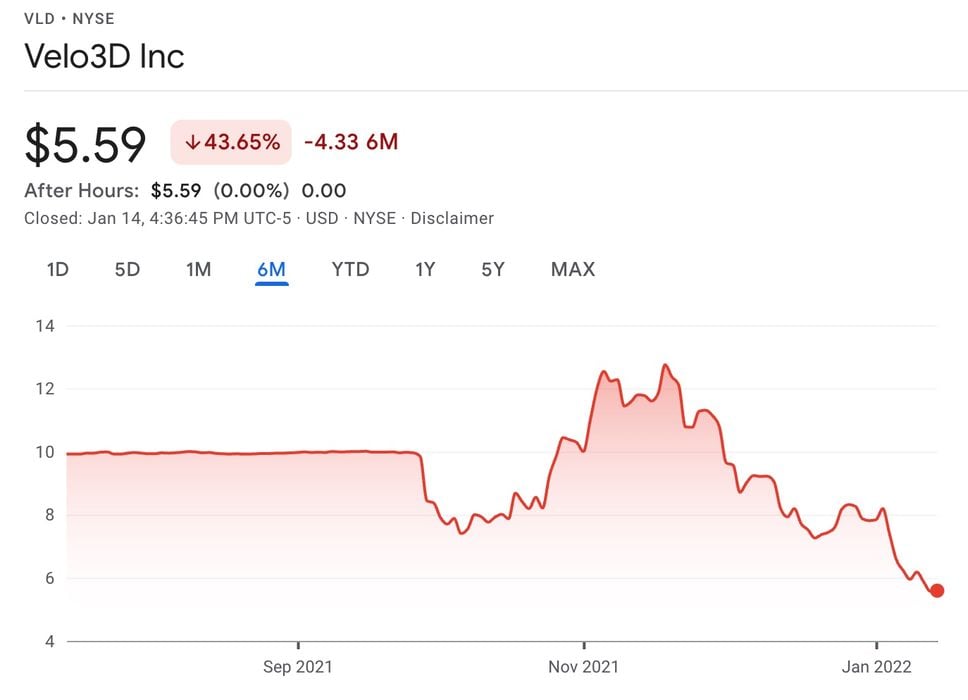

Velo3D continued dropping, as it has done for several weeks now. This week they suffered another ten percent loss in value, relegating them to eighth place on our list. As you can see in this chart, their value has been swinging constantly downward since November. (Note that the flat period prior to October on the chart represents the SPAC holding company they worked with to more quickly get on the NYSE.)

This is all quite puzzling to me. The company posted very strong results for 2021Q3, but has yet to publish their Q4 results. They are known in the industry for excellent service, outstanding technology that is unique in the metal 3D printing domain and have tons of potential.

So why is their value dropping? It may be that investors are unsure of consistency and fear poor results for Q4, or perhaps their tech is simply not well-understood by general investors. With the current boom in metal 3D printing, I suspect Velo3D will bounce back strongly at some point.

Markforged suffered more than a nine percent loss in value this week, likely due to their announcement of a management shuffle. While they gained a new Chief Marketing Officer, they also lost their original CTO, David Benhaim, this week. Benhaim will remain as an advisor until July. The CTO transition was apparently a long-planned move, but evidently unseen by surprised investors, resulting in knee-jerk selling after seeing the headline.

Another unfortunate company this week was Shapeways, which continues to drop in value. This week cost them another near-16 percent. As of this writing their market cap was US$121M, down from a far massive high of US$564M last October. As I’ve stated previously, it is likely investors are seeing their initial thoughts of the company being a consumer-oriented operation to one serving industry, their current target. That market is filled with powerful competitors, making it more challenging for the company to succeed.

Nano Dimension did not change much in value, in spite of a key announcement in which they are partnering with XTPL to make use of high resolution conductive ink in their 3D printers.

Upcoming Changes

We are still awaiting the appearance on the market of one more 3D print company: Fast Radius, a digital manufacturing cloud service.

Another company set to appear in early 2022 is Essentium, who announced plans to use a SPAC-merger to launch on NASDAQ.

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t know exactly what it is at any moment. The suspected bigger companies include EOS, Carbon, Formlabs and SLM Solutions.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.