It’s IPO news today for Xometry as the on-demand manufacturing company prepares to trade on Nasdaq under “XMTR.”

The latest company in advanced manufacturing to enter the public arena, Xometry is taking an increasingly popular bold next step in its evolution. This move follows some big figures of trust in the company’s business model, including escalating investment figures. Xometry raised, for instance:

- $23 million in 2017

- $50 million in 2019 — quickly upped to $55 million

- $75 million in 2020

As part of last year’s $75M raise — which brought total funding to $193M since Xometry was launched in 2014 — the company brought onboard a new CFO with IPO experience. Jim Rallo’s appointment raised eyebrows in the IPO direction due not only to that previous experience (as the CFO and President of Liquidity Services) but that it was highlighted in Xometry’s announcement, which ensured that it noted he led that company’s initial public offering in 2006.

In the recent spate of companies in the additive manufacturing industry going public — among them Desktop Metal, Markforged, VELO3D, Massivit 3D, and fellow service provider Shapeways — many have forgone the classic Initial Public Offering and instead chosen the Special Purpose Acquisition Company route. Of the aforementioned 3D printing companies moving toward the open market recently, only Massivit 3D opted for an IPO over SPAC.

Xometry IPO

Now, then, it’s time for the next raise as the company reveals that it “has filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission (‘SEC’) relating to a proposed initial public offering of shares of its Class A common stock.”

Not too many details are available on the heels of the announcement. The SEC form S-1 is dated today, June 4, 2021, and indeed it is not yet fully filled out. (The press release notes that it has been filed but is not yet fully effective.) As of press time, the S-1 states in part (blanks and all):

“This is an initial public offering of shares of Class A common stock of Xometry, Inc.

Prior to this offering, there has been no public market for our Class A common stock. It is currently estimated that the initial public offering price for our Class A common stock will be between $ and $ per share. We have applied to list our Class A common stock on The Nasdaq Global Select Market under the symbol ‘XMTR.’

Following this offering we will have two classes of common stock: Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting, conversion and transfer rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to 20 votes and is convertible at any time into one share of Class A common stock. Immediately prior to the completion of this offering, certain outstanding shares of our capital stock held by Randolph Altschuler, our Chief Executive Officer and Co-Founder, and Laurence Zuriff, our Chief Strategy Officer and Co-Founder, will be exchanged for shares of our Class B common stock. The holders of our Class B common stock will hold approximately % of the voting power of our capital stock immediately following this offering.

We are an ‘emerging growth company’ as defined under the federal securities laws and, as such, we have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.”

Further, company representatives are currently “declining interviews and requests for comment, unfortunately,” we are told, so it will be just a little longer before we have full details on the financial plans for and corporate implications of an IPO.

A report at Forbes prices the IPO move around $100M and notes that the company “was valued at $558 million at its last funding round led by T. Rowe Price in September 2020, according to venture-capital database PitchBook.”

Xometry On-Demand Manufacturing

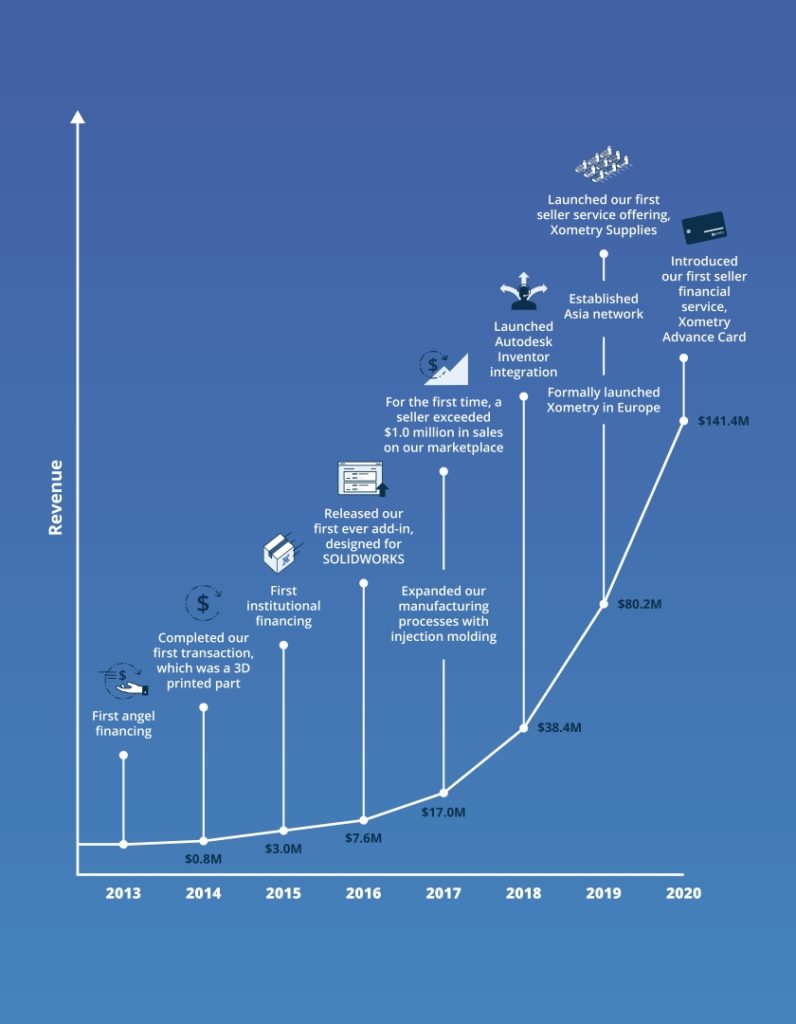

Xometry itself has been on a significant growth curve for some time now. Also in the S-1, we see this very nicely rising revenue report:

Rising to $141.4M in revenue in 2020 — a hefty jump up from $80.2M the year before — shows the versatility and adaptability at Xometry, as business growth during a pandemic is no small thing.

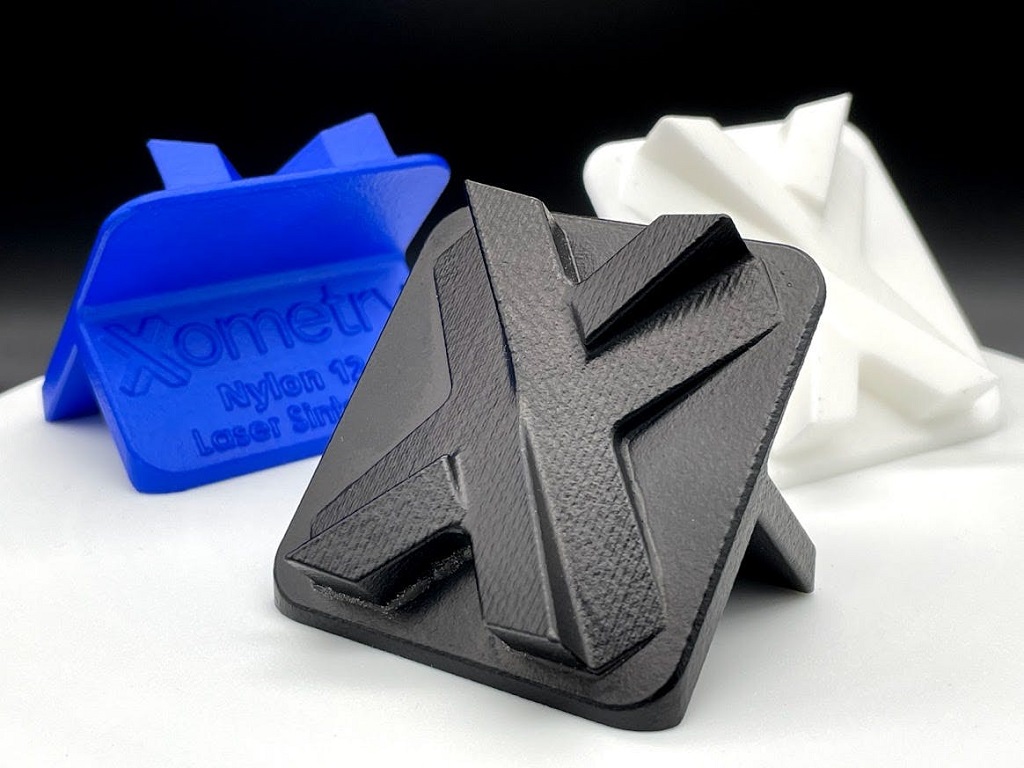

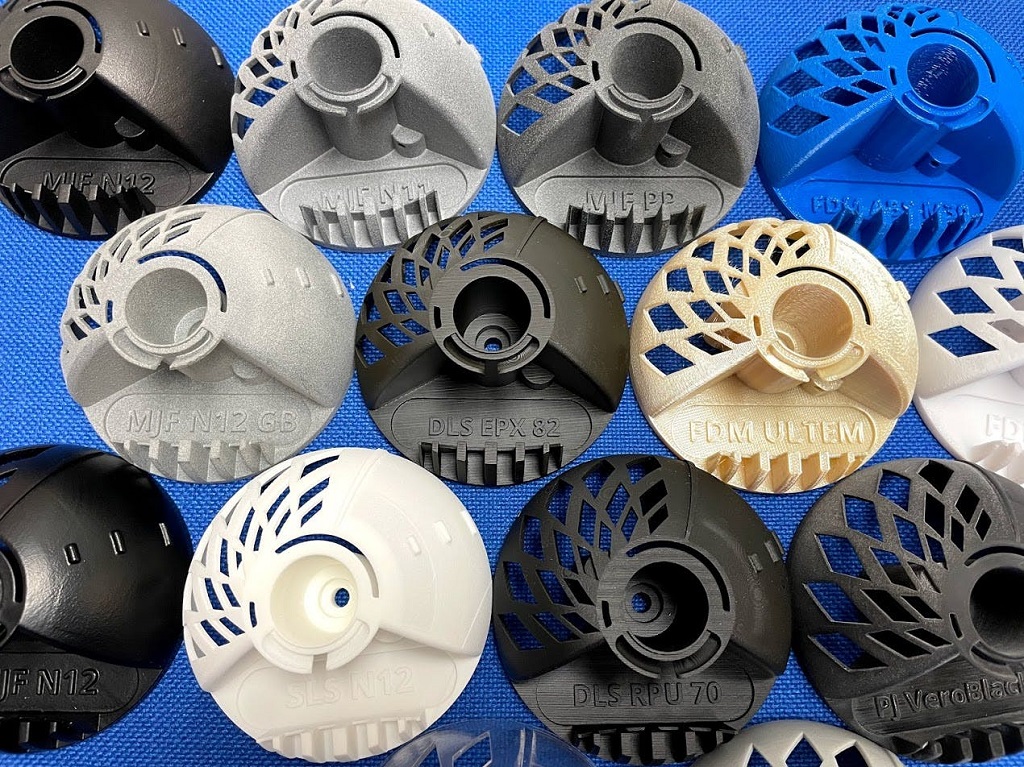

We are of course interested in Xometry primarily due to the company’s commitment to high-quality 3D printing, but this is by no means the only technology suite available. Hold on to your hats for a bullet list of manufacturing processes available through the Xometry marketplace:

- CNC

- CNC Machining

- CNC Milling

- CNC Turning

- Sheet Metal

- Sheet Metal Fabrication

- Waterjet Cutting

- Laser Cutting

- Plasma Cutting

- 3D Printing

- 3D Printing Service

- Binder Jetting

- Carbon DLS

- Direct Metal Laser Sintering

- Fused Deposition Modeling

- HP Multi Jet Fusion

- PolyJet

- Selective Laser Sintering

- Stereolithography

- Injection Molding

- Injection Molding

- Insert Molding

- Overmolding

- Other

- Urethane Casting

- Finishing Services

- Rapid Prototyping

- High-Volume Production

- Vapor Smoothing

The Xometry platform connects those in need of parts and services with a huge network of providers ready to offer them (including the likes of Stratasys Direct Manufacturing). A very smart AI marketplace and quoting setup make everything effectively instantaneous; parts can be delivered in as little as a single day, depending on the order.

“Our partner network now spans the globe to support the needs of customers and to help drive the business of local machine shops and manufacturing facilities. Partners do not pay to sign up for our network. Our algorithm sends jobs to a list of carefully vetted facilities with matched capabilities. Xometry’s Project Engineering team is always responsible for making sure the parts are done correctly and on time,” Xometry explains of its setup.

Today’s IPO announcement is no surprise to those who have been paying attention to the Xometry trajectory; really there’s nothing to say to the company but “congratulations!” as we wait for everything to fall into place for XMTR.

Via Xometry, SEC, and Business Wire