Charles R. Goulding and Arianna Coger take a look at an optimized design made possible via 3D printing.

HP Inc. and Siemens, two large multinational tech companies, have been partnered for several years with the shared goal of improving and expanding the use of additive manufacturing. HP has branched out from the PC and 2D print industry to developing 3D printing technology and has become a major player in the global 3D printing industry. Siemens has focused more on developing software for analytics and collaborating with companies that use 3D printing to improve their processes.

The combination of the HP Multi Jet Fusion 5200 3D printer and Siemens’ simulation software facilitated the 2019 development of the “The Mighty Duct,” an air duct with completely optimized airflow, which is now used in the cooling system of the HP Multi Jet Fusion 5200.

Why 3D Print It?

Initially, HP planned to traditionally manufacture the air duct of the HP Multi Jet Fusion 5200 using injection molding rather than with 3D printing. However, the original design of the air duct would have required six separate injection molded components to be assembled to produce just one duct. 3D printing would allow it to be manufactured in one piece instead, leading to a simpler, more efficient, and cheaper process. It was easy to see that 3D printing was the more advantageous solution once they had considered both options.

Why This Design?

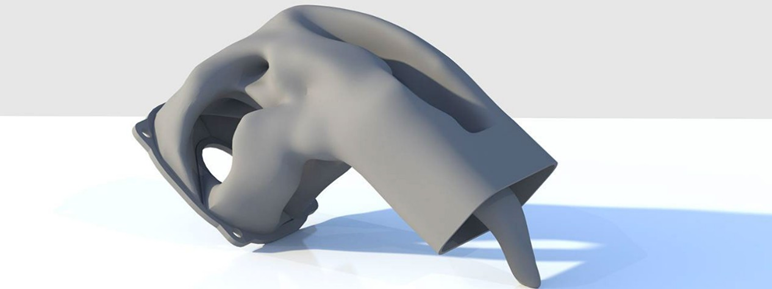

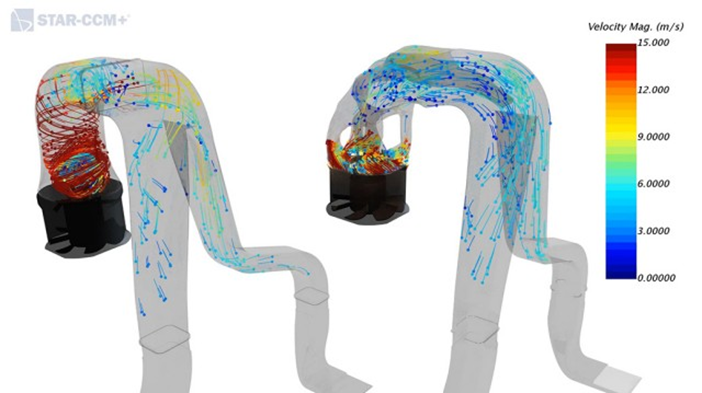

The strange geometry of their new air duct design is due to the use of Siemens’ Simcenter Star-CCM simulation software to analyze the airflow within their original duct using computational fluid dynamics (CFD). This allowed them to visualize and predict typical airflow patterns.

The HP and Siemens team were able to identify areas of the traditionally designed air duct where air would often become trapped, leading to reduced airflow. Siemens’ software was utilized to generate an optimized topology for a new design that they never could have thought of on their own.

Sections that were slowing down airflow and wasting space were removed. Instead, the new design included four distinct paths where air could flow most efficiently. They were pleasantly surprised to find the software’s prediction of optimizing airflow by 22% accurate. Overall, the new design would allow their printer to run faster and more reliably due to a more efficient cooling system.

According to HP, it would typically take approximately four months to complete the design, printing, and testing process with only mechanical engineers working on the part design. The simulation software, combined with 3D printing, reduced the length of this process to only take one month.

Potential Applications

The usage of simulations to optimize the design of 3D printed air ducts can be applied to a multitude of companies and industries. The potential of 3D printing in conjunction with simulations within the HVAC industry, in particular, continues to grow while many of its companies still have not utilized the full potential of the technology.

Federal tax incentives, such as the Research and Development (R&D) Tax Credit, are available for companies that engage in 3D printing activities.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The usage of simulations to discover and outline the optimal 3D printed designs can help improve efficiency and sustainability. As more companies discover the potential of this technology, they are sure to integrate it within their own facilities and development processes.