Charles Goulding and Ryan Donley examine growing opportunity for 3D printing in a restructuring oil and gas industry.

Warren Buffet’s $9.7 billion acquisition of Dominion Energy’s gas transmission and storage business, Jim Ratcliffe of Ineos’ $5 billion acquisition of BP’s remaining petrochemical business, and Chesapeake Energy’s bankruptcy are very recent transactions shaking up the oil patch.

Anything Warren Buffet does get worldwide attention and is often trendsetting. Jim Ratcliffe previously purchased a major petrochemical segment from BP for $9 billion and he already has a $60 billion sales empire. Ratcliff has also purchased chemical assets from ICI and BASF. Chesapeake was once the nation’s largest share gas driller and has been working on a restructuring plan for years but ran out of time when the pandemic hit. Additional oil and gas companies are also expected to declare bankruptcy.

The 3D Printing Opportunity

The oil patch including natural gas compressors and oil pumping stations use a variety of legacy manufacturing equipment often situated in remote areas. Many of the underlying equipment manufacturers have also gone out of business and the equipment needs a constant stream of replacement parts.

This situation is ideal for 3D printing applications. Baker Hughes has substantial 3D printing expertise and should be well situated to capture some of these opportunities.

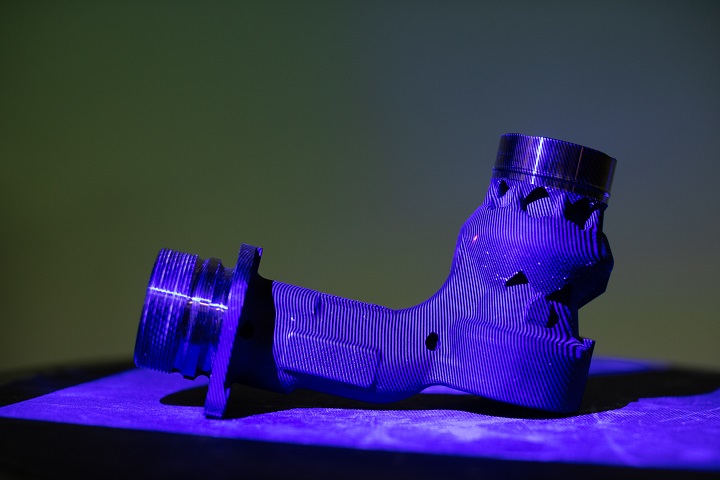

In fact, Baker Hughes has been one of the earliest adopters of additive manufacturing technology and practices in the industry after installing a direct metal laser melting machine in 2013. The result was the ability to 3D print a new generation of parts including a new natural gas turbine. The company has since expanded and added two more machines in an attempt to practice additive manufacturing on a day-to-day basis.

Baker Hughes now is looking to develop a catalog of spare parts with their improved capabilities as well as developing complex geometrical parts such as centrifugal pump impellers.

New Technology Introduction Engineer at Baker Hughes, Edoardo Gonfiotti, stated the importance of additive manufacturing to the company and industry, “This is a key enabler if you want to be an important player in the carbon-footprint reduction landscape and the overall emission-reduction OEM landscape, the boundaries of development have become significantly wider, enabling our company goals of pursuing designs to help lower emissions – and doing it at speed. These are the two things that I see as really important for the company and for oil and gas development and change in the next few years. I’m not talking about decades, I’m talking about just a few years.”

3D printing and similar activities in the oil and gas industry may be eligible for the R&D Tax Credit, which is briefly described below.

The Research and Development Tax Credit

Companies working in innovative products related to any of the categories above should take advantage of Research and Development (R&D) tax credits. Enacted in 1981, the now permanent Federal R&D Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Troubled industries and in particular troubled companies in troubled industries companies typically underinvest in new technologies. With Americans returning to the road and the natural gas sector restructuring the oil patch may be a sector the 3D printing industry should start drilling into.