Charles R. Goulding and Preeti Sulibhavi examine trends in new CEO appointments in several 3D printing companies.

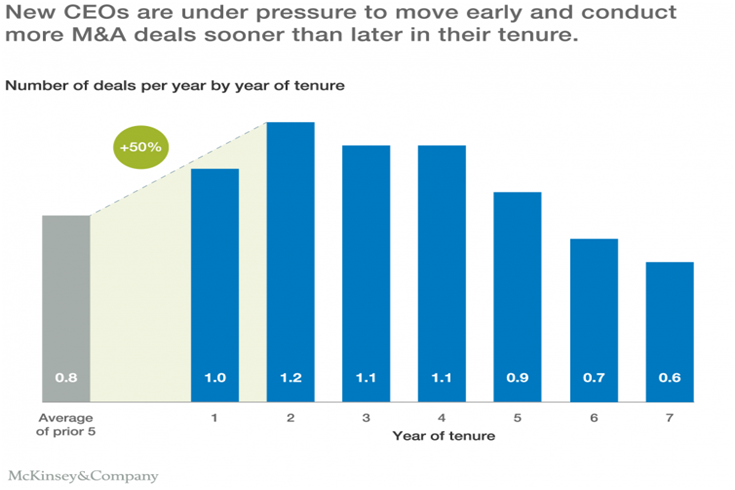

A study performed by McKinsey based on Fortune 500 companies indicates that new CEOs tend to complete more acquisitions at the beginning of their tenure. Since at least seven of the leading 3D printing companies have new CEOs, this means that the 3D printing acquisition environment may soon get interesting.

These new CEOs are:

- Enrique Lores at HP Inc.

- Yoaf Zeif at Stratasys

- Ellen Kullman at Carbon

- Larry Culp at GE

- John Hartner at ExOne

- Jeffrey A. Graves at 3D Systems

- Marie Langer at EOS

The ongoing pandemic has probably delayed acquisition activity but favorable factors include low-interest rates and large amounts of available capital. The 3D printing industry has numerous companies and arguably is ripe for consolidation.

The auto and aircraft industries have been two of 3D printing’s leading categories and both industries are quickly emerging from historic lows. We suspect some investment bankers are crunching the deal scenario numbers right now.

Once one of the new CEOs makes a move, the others will have to re-evaluate their current strategic positions and other acquisitions may follow as a result.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax for companies with revenue below $50MM, and startup businesses can obtain up to $250,000 per year in cash rebates applied directly toward payroll taxes.

Conclusion

Historical data indicates that new CEOs act on acquisitions sooner rather than later. With these new 3D printing CEOs, let us see if history repeats itself.