Charles R. Goulding and Preeti Sulibhavi look at a recent expansion of 3D printing capacity by Collins Aerospace.

[Source: Leeham News & Analysis]

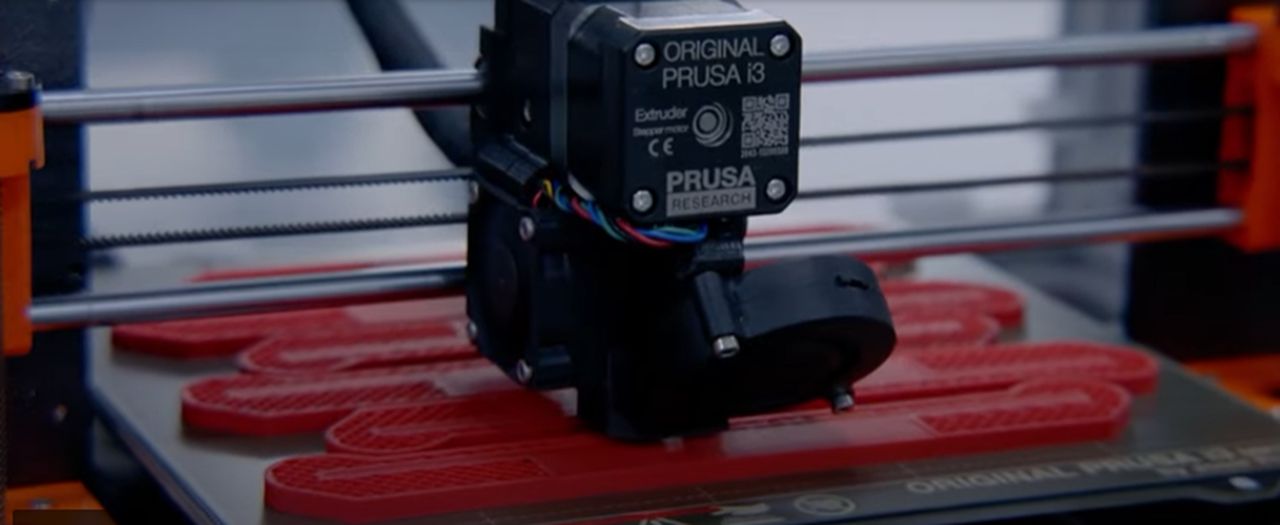

In June of 2022, Collins Aerospace added 3D printers to its large 160,000sf (15,000sm) MRO facility in Monroe, North Carolina. An MRO is a Maintenance, Repair and Overhaul facility. Collins Aerospace already has an international 3D printing network with 3D printing capability in Connecticut, Iowa, Minnesota, Poland and Singapore.

Collins spent US$30M expanding the facility in 2022 and has invested US$15M since then Monroe handles 6,500 different part numbers. The MRO supports military and commercial aircraft. The parts that can be 3D printed will enable Collins to reduce standing inventory costs. Onsite 3D printing capability reduces supply chain costs related to freight and transportation and improves quality control.

A network such as this allows each location to contribute expanded 3D printing solutions capability to the entire network.

The value of a network expands exponentially with increased and expanded end user nodes. Moreover, new MRO 3D printing field experiences can be relayed back to OEM manufacturing sites to design and create improved components from the onset.

The VP at Collins, Kevin Myers, has been quoted as saying, “By using additive manufacturing to produce aircraft parts and components, we can help reduce weight, cost and time to market, and provide more sustainable solutions for our customers.”

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Collins Aerospace is a division of Raytheon Technologies which is now the second-largest US defense contractor after Lockheed. In theory, the expanded Collins’ 3D printing expertise can be shared throughout the global enterprise.