Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number to compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s first take a look at the major 3D printing companies on this week’s list. I consider these companies “major” because their market valuations are significantly larger than others in the space.

Major Players

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 3,751 | +74 |

| 2 | Desktop Metal | 3,732 | +261 |

| 3 | Protolabs | 2,447 | -28 |

| 4 | Nano Dimension | 1,914 | +147 |

| 5 | Materialise | 1,527 | +65 |

| 6 | Stratasys | 1,456 | -10 |

| 7 | ExOne | 491 | +17 |

| TOTAL | 15,318 | +525 |

This week saw a slight change in ranking among the larger 3D printing companies, but there were definitely some interesting movements.

Desktop Metal, which held the lead for months, lost it to 3D Systems in the past few weeks due to significant financial developments at that company. Their new management has been slashing non-core activities and generally tuning up the profits. This led to notable increases in the company’s value, and put them in the top spot.

While 3D Systems had a major announcement this week regarding the sale of their historically significant service business, it appears the market has already priced in expected cuts and divestitures, as 3D Systems’ price rose only by two percent.

Meanwhile, Desktop Metal is catching up. This week they are a mere US$20M behind, but still in second place. That’s a difference of only half a percent in value. The nearly eight percent rise by Desktop Metal that occurred on 2 June might have something to do with the qualification of a new metal for use in their Production System platform.

Finally, Stratasys has dropped one rank due to a combination of a US$65M gain by Materialise, and a US$10M loss by Stratasys. This places Materialise in 5th spot, while Stratasys drops to 6th.

Other Players

| RANK | COMPANY | CAP | CHG |

| 1 | voxeljet | 89 | +2 |

| 2 | ARC Group WW | 36 | +4 |

| 3 | AML3D | 23 | +1 |

| 4 | Aurora Labs | 9 | 0 |

| 5 | Tinkerine | 3 | +1 |

| 6 | Massivit | TBD | TBD |

| TOTAL | 161 | +7 |

The lesser valued companies tend to have much smaller shifts in their market capitalization because there is far less trading occurring on their stocks. The big money tends to hover around the larger players.

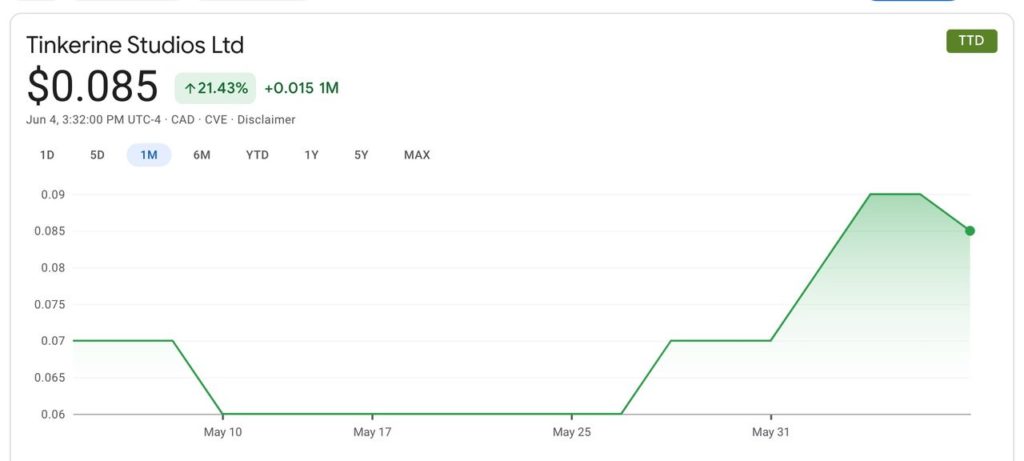

This week saw a very significant change to the smallest player on our tracker: Tinkerine. For those not familiar with them, they are a small manufacturer of desktop 3D printers targeted at the education market, and based in Vancouver, Canada.

Their price rose an incredible 40% this week, with their stock rising from US$0.06 to US$0.09. That’s a penny stock, for sure, but you can bet there were some happy folks at Tinkerine this week.

Note that we are unable to obtain Massivit’s market cap value, as it does not seem to be published, even though they are a publicly traded company on the Tel Aviv Stock Exchange.

Upcoming Changes

Our list of pending stocks has changed! While Markforged, Shapeways and VELO3D have all previously announced their intent to be publicly traded in the near future, this week we add Xometry.

The California-based manufacturing network makes extensive use of 3D printing and has been growing rapidly, putting them in an excellent position to go public. Unlike many other recent moves, Xometry is doing a traditional IPO where they execute a standard, but expensive, paperwork process for entering a stock market. This differs from others that have used the SPAC approach: buy a placeholder company that’s already on a stock market and “become them”.

All of the four pending changes will likely end up on our list of major players, with some possibly threatening top rankings.

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t know exactly what it is at any moment. The suspected bigger companies include EOS, Carbon, Formlabs and SLM Solutions.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.