Charles R. Goulding invites expert attorney Bob Ward to examine industrial 3D printing impacts from trade laws.

Introduction by Charles R. Goulding

I asked Bob Ward, a leading International Trade Attorney based in Houston, Texas to give our 3D printing audience a primer on U.S. international trade laws. Bob has functioned as a senior trade advisor for multiple leading U.S. companies including HP Inc., WESCO/Anixter, and Cooper Tools which was later sold to Stanley Black & Decker. The U.S. is the global leader in 3D printing which means many of our 3D printing companies are exporting. The U.S. has tough laws that control the export of certain specified products and also regulate the sale of products to certain countries. It is important to be informed about these laws.

By Robert J. Ward, Jr. Esq., U.S. Certified Export Compliance Officer:

Given how prevalent additive manufacturing is becoming in global supply chains, there are high-profile export control regulatory traps for the unwary that merit careful attention. Additive manufacturing is one of the Department of Commerce’s targeted “emerging technologies” of concern considered as part of recent Wassenaar Arrangement discussions for multilateral export controls. The issue centers on how the process can be used both for civilian and military purposes (so-called “dual-use” potential), depending on who is making what with which materials and for what intended end-use.

The high-profile regulatory traps for the unwary in globally deploying additive manufacturing stem from three key sets of U.S. laws. The first is the International Traffic in Arms Regulations (ITAR); the second is the Export Administration Regulations (EAR); and finally, there are the Office of Foreign Asset Control (OFAC) regulations. Additive manufacturing has afforded a significant leap forward in improved manufacturing of complex components, all while significantly reducing waste. It has, above all, permitted the use of lighter weight yet stronger materials for making parts of value in the aerospace industry. The state of the technology has given the U.S. military an advantage that the U.S. government keenly wants to preserve for national security, non-proliferation, anti-terrorism and foreign policy reasons.

This article will review each of the three key regulatory areas and their impact on the additive manufacturing industry to raise awareness on the need to plan for, comply with and implement proper controls to avoid draconian penalties and adverse publicity.

ITAR

For 3D printing manufacturers, it is necessary to be registered annually with the Department of Defense Trade Controls (DDTC). This is required whether or not the manufacturer exports themselves. This is because resellers often will re-export, and the DDTC wants to be made aware of the players as a matter of precaution.

Through recent export control reform, many ITAR controlled items (such as energetic [explosive] materials) have been transferred to Commerce’s Control List. This can be discerned readily from the below chart:

| Items | USML Cat. | ECCNs | P: Proposed Rule F: Final Rule | Effective Date |

| Explosives/Energetic Materials | V | 1B608, 1C608, 1D608, 1E608 | P: USML V; CCL 1Y608 F: USML V; CCL 1Y608 | July 1, 2014 |

Where ITAR still plays a major role is with respect to defense services. That is, services provided by application engineers vis-à-vis defense-related digital print instruction files are still controlled under ITAR. Applications for required export licensing must be lodged through the new Defense Export Control and Compliance System (DECCS). DECCS is also the platform for the annual DDTC registration.

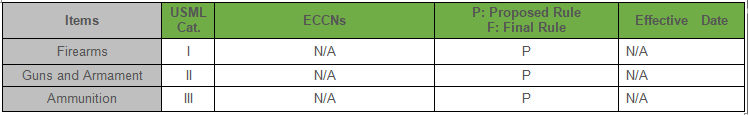

Please note that the early controversy surrounding the additive manufacture of personal firearms is still subject to control under ITAR as this chart poignantly indicates (i.e., no migration to Commerce whatsoever):

Should R&D be undertaken (even if within the United States only), defense-related technology development is subject to so-called deemed export and re-export controls. That means, someone, working on the R&D project with citizenship (or prior citizenship) from a country of concern, will require a DECCS export license prior to having access to the research materials. If access is attained within the U.S. before authorization, then a deemed export to the country of citizenship (or prior citizenship) will be treated under ITAR as having been done. Similarly, if the research materials are provided to the R&D center located in a friendly country, having someone with citizenship or prior citizenship of a country of concern will be treated under ITAR as having been re-exported to the home country.

The DDTC registration, defense services as well as deemed export and re-export regulations all pose traps for the unsuspecting companies just launching their products, software and technology globally. If an approved license is not attainable, then a comprehensive technology control plan will have to be created to ensure the technology is not shared with someone coming from an “unfriendly country”. For example, electronic files will need to be encrypted and password protected and destination control statements will be needed on documents.

EAR

The EAR poses similar problems as ITAR, but with a far greater scope. It is the fact the proposed export has the potential to be used for military purposes (even though initially intended for civilian end-uses) that can trigger a license requirement for a particular destination and/or end-use/end-user. When required, a license application must be filed through the Department of Commerce’s Bureau of Industry and Security’s Simplified Network Application Process – Redesign (SNAP-R system).

Multiple EAR Export Commodity Control Categories can cover additive manufacturing and associated building materials. For example, technology to produce materials of concern (e.g., powdered metals) are currently controlled under Category 1 of the Export Administration Regulations (EAR), and technology for the development of additive manufacturing machines specially designed to develop or produce military items are currently controlled under Categories 0, 1, 3, 6, 7, 8, and 9 of the EAR.

The same deemed export and deemed re-export controls described above for ITAR apply for technology covered under the EAR, except that the current country of citizenship is the focus (even green card holders are considered to have sufficient allegiance to the U.S. so that a license will not be required for either that group or of U.S. citizens).

OFAC

The OFAC regulations cover transactions with certain designated groups of ill repute (be they individuals or corporate organizations and/or partnerships). These are the regulations that comprise the main part of so-called economic sanctions laws. The sanctions laws of the U.S. enforce laws such as the International Emergency Economic Powers Act as well as the Trading with the Enemy Act. As might be guessed, violations of these laws bring the highest profile enforcement activity, including damaging press coverage as well as the appointment of an internal monitor where conduct is deemed to be particularly egregious.

Other collateral damage from inadvertently undertaking business with a so-called OFAC specially designated national (SDN) is that the NYC clearing house banks for U.S. dollar wire transfers will start to impose stringent vetting requirements on the identity of all the parties to the transaction (including the beneficiary identity not to mention the underlying details of the bona-fides of the commercial transaction).

A tricky area for additive manufacturers is undertaking the required screening of all potential business partners (just in case one of these SDNs should rear their ugly heads). Where screening can be automated, that is ideal to ensure it is done in a timely manner and that necessary transaction holds are imposed should a potential match be at issue. If automation is not possible, then human transaction-by-transaction screening will be necessary.

Such screening is even required for technical support as well as warranty work (as 3D printers, for example, can be resold along with the transfer of the tech support and warranty agreements). The proper and timely intervention in such scenarios can be elusive. A tech support request that might come in from a URL indicating the country of origin of the request might be one of the embargoed countries is particularly difficult. The region of Crimea (formerly part of Ukraine), Cuba, Iran, North Korea and Syria are currently under a comprehensive U.S. embargo. Accordingly, it is necessary to set up one’s screening software to capture URL addresses from these countries so that an automated message can be sent that service cannot be provided to that jurisdiction under U.S. law.

Another enormous difficulty is when there is no specific URL associated with an embargoed region, as is the case respecting the Crimea. In that instance, it will be necessary to input all postal codes associated with addresses in the Crimea so that the screening software can pick those up for further vetting.

Conclusion

Additive manufacturing is presenting significant improvements in making devices and components for the healthcare, aerospace, automotive, consumer product as well as defense industries. However, launching a global sales campaign will involve direly needed compliance with certain critical export control laws. Already knowing how ITAR, EAR and OFAC regulations can be implicated is a key first step toward proper compliance. That is, knowing when to request help is already mission critical rather than unwittingly suffering the embarrassment and potentially fatal penalties that can arise under these regulatory regimes.