Charles R. Goulding considers financial implications of GE’s relationship with Baker Hughes and where 3D printing comes into the picture.

GE owns 37 percent of Baker Hughes (BKR), the giant international oil and gas services company. With the recent increase in oil prices (now over $50 per barrel) GE’s investment in BKR has risen to $9 billion in value. GE once owned all of BKR but has steadily been divesting its holdings.

3D Printing at BKR

The oil and gas service business is equipment-intensive and requires constant component and part replacements including pumps, valves, compressors and fasteners. BKR is the result of combining numerous oil and gas service companies over many years with a myriad of product lines.

BKR and Würth Industry of North America, (a subsidiary of Germany-based Würth, the world’s largest fastener company), recently announced a 3D printing joint venture to address the opportunity of providing 3D printed replacement parts for products in the oil and gas industry. Wurth is also a Markforged 3D printer distributor. Digitizing replacement parts at central hubs in the oil patch will materially reduce the industry’s carbon footprint.

In November 2020, BKR agreed to purchase Compact Carbon Capture (3C technology) of Norway. In November 2020, we wrote a Fabbaloo article about BKR‘s use of 3D printing. In July 2020, we wrote a Fabbaloo article about 3D printing pumps for the oil and gas industry. This should illustrate how fast this industry is growing and utilizing 3D printing technology.

3D Printing at GE

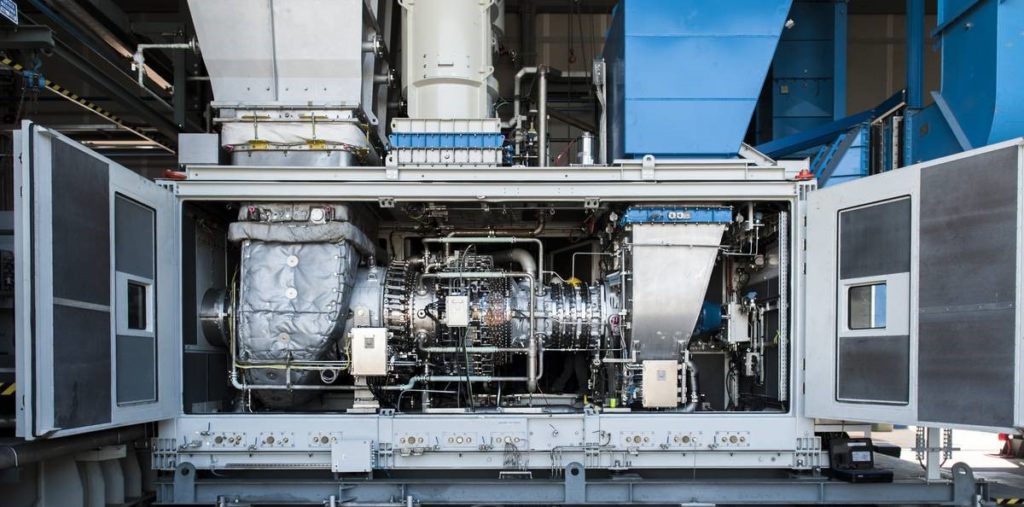

GE itself has a large 3D printing business, GE Additive, and is also a major provider of 3D printing for internal use including for jet engine components, turbines, propellers and a myriad of other parts. After reaching the financial precipice, the company is on the rebound. This growth will only accelerate once the airline industry returns to its former self.

GE has a growing wind segment and has caught the wind energy industry’s attention with new giant wind turbines. As GE continues to divest its interest in BKR, hopefully at higher share prices, it will generate internal capital to fuel future growth.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

BKR continues to make further use of 3D printing technology. GE was forced to sell other businesses to raise cash and survive financially while oil prices were depressed. At the time this article was being drafted, GE sold an additional $735 million in Baker Hughes stock. Hopefully, the sustained rise in oil prices will enable the company to sell more BKR stock at higher prices to generate the working capital it needs to return to the airline market soon.