Charles R. Goulding and Preeti Sulibhavi propose increased use of 3D printing to help refurbish liquidated products.

To our surprise, the Sunday, July 31st, 2022, New York Times (NYT) had a front-page article on the strength of the reverse logistics liquidation market. We all are aware of the large volume of products sold by major retailers including Amazon, Target, and Walmart among others.

What isn’t widely known is that in 2021 consumers returned over 16 percent of those purchases. The post-Covid-19 environment is creating record levels of returns on some popular 2020 product purchases including barbeques, bikes and patio equipment, to name a few. For all of these returned items, 3D printing can be utilized to repair and make replacement component parts.

The NYT article focused on a publicly traded liquidator called Liquidity Services. Liquidity Services has some impressive case studies on its website, including large commercial transactions involving oil and gas equipment, kitchen and baking equipment products, and patio furniture, which all have 3D printing opportunities we have covered in past articles.

The oil and gas case study involves a relationship that has generated over $70 million in sales. The bakery case study centers ZIV, a large Bulgaria-based baker, that has concluded over 200 bakery equipment transactions across the globe. The patio furniture case study highlights 60 truckloads of patio furniture.

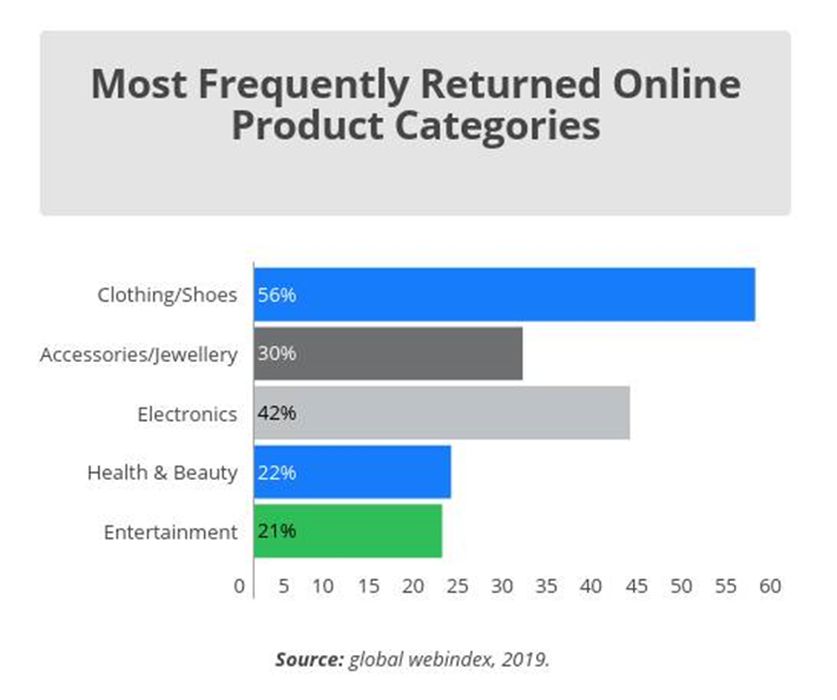

The electronics market is no exception to this trend either. In fact, aside from clothing and accessories, it is the most frequently returned online product category (as depicted in the graph below). It is becoming increasingly easier to refurbish and repair electronic items and 3D printing is helping to achieve quality results. Additionally, robots and automation are helping to accomplish these 3D printing goals.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

The unprecedented level of returned goods post-Covid-19 is occurring while the use of 3D printing has expanded for many of the returned product categories. Knowledgeable liquidators can use 3D printing to repair and replace imperfect returned goods and then charge a higher sales price.