Charlie Goulding and Preeti Sulibhavi consider some applications of 3D printing in an upcoming major infrastructure bill.

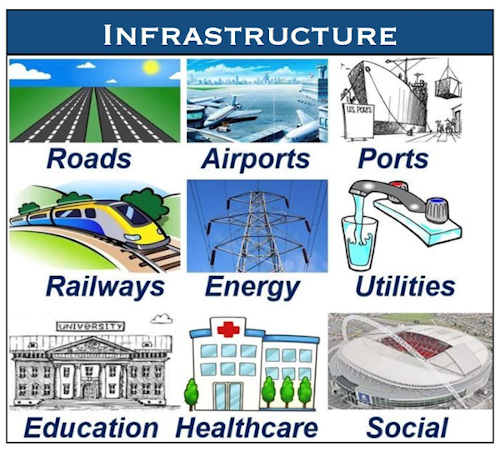

A Trillion-Dollar Infrastructure Bill may soon be ready, which would be a great way to address America’s long-standing infrastructure deficiencies while creating a large number of new jobs. The creation of these new jobs is particularly important for replacing permanently lost positions due to the novel coronavirus pandemic. In addition to commonly recognized infrastructure categories such as highways, railways, bridges, and tunnels, the developing program is to include 5G and rural broadband support.

Although both political parties have previously mouthed support for infrastructure funding, nothing ever seems to happen. Now, the genuine need may finally hurdle the politics although the pre-election agreement is doubtful.

3D printing opportunities exist in specific related areas, which can be summarized as follows:

1. 5G network and Ericsson & Nokia antenna technology

2. A new army of infrastructure installers are going to need tools. Stanley Black and Decker, the world’s largest tool manufacturer has made extensive use of 3D printing.

3. Infrastructure projects need a myriad of fasteners. Nucor, America’s largest steel company, also has a large fastener business segment.

4. The rail industry has deployed robots to disinfect trains using UVC Light and Siemens Mobility, one of the world’s largest train manufacturers, has used 3D printing to allow rail passengers to open doors with their elbows.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax for companies with revenue below $50MM, and startup businesses can obtain up to $250,000 per year in cash rebates applied directly toward payroll taxes.

Conclusion

Long-awaited infrastructure investments may finally come to fruition and 3D printing has a vital role to play in this development.