Charles R. Goulding and Ryan Donley take a look at ExOne’s major foray into bringing 3D printing where it needs to be.

The United States Department of Defense and US military branches have been significantly expanding efforts in the 3D printing field. The use of 3D printing has reached all branches of the military and is still growing as software and hardware components are unprecedently being combined in applications such as autonomous unmanned vehicles, including submarines, drones, and helicopters.

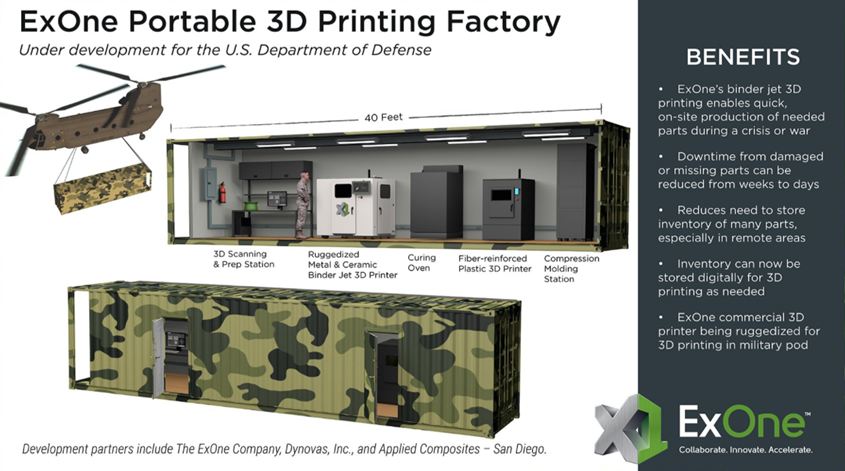

The military’s interest in 3D printing has become even more evident as the Department of Defense just recently awarded Pennsylvania-based ExOne a $1.6 million contract to develop a portable factory for 3D printing. This contract will presumably meet the United States’ new, more rigid Buy American goals. We discuss both the Federal and Pennsylvania R&D Tax Credits later in this article.

The portable factory is within a shipping container enabling it to be moved and operated efficiently in the field. Within the 40-foot-long container is a 3D Scanning & Prep Station, Ruggedized Metal & Ceramic Binder Jet 3D Printer, Curing Oven, Fiber-reinforced Plastic 3D Printer, and a Compression Molding Station.

The idea of 3D printing in a portable container that can be deployed as-needed has been taking off lately, especially among military applications. One large-format 3D printer is also itself made in a shipping container. The ExOne solution offers an interesting binder jetting angle to the idea.

ExOne CEO John Hartner is very familiar with binder jet 3D printing. When we interviewed John in 2019, he outlined how the technology fits into broader production environments. According to John:

“I think there are multiple buttons to push to accelerate the adoption of 3D for production. The good news is we’re producing the best technology in 3D printing, which is binder jetting. This is the technology that our customers are saying they want they’re super excited about it they’re designing their roadmaps on it.”

Portable 3D Printing Factories in Other Industries

The oil and gas industry utilizes complex and expensive equipment and machinery. Employing 3D printing to rapidly prototype parts on site will significantly reduce downtime and enhance the supply chain. The oil patch segments suffer from missing crucial parts often built by legacy manufacturers that no longer exist and need replacing immediately, and not readily available in the supply chain. A portable 3D printing factory can reduce the numerous challenges faced in the oil patch. Other field environments that could benefit from the portable 3D printing factories include FEMA, disaster recovery, pandemic services, mining, shipping, and construction.

3D printing and similar activities used for developing military parts and components may be eligible for Research and Development (R&D) Tax Credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, and startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Pennsylvania R&D Tax Credit

The Pennsylvania State Research & Development Tax Credit largely mirrors the Federal Research & Development Tax credit discussed above. Typical qualified expenses include the following:

- Wages paid to employees for qualified research services

- Cost of supplies used directly in research activities

- 65% of amounts paid to others for contracted research

Many non-manufacturing companies earn Pennsylvania R&D Tax Credits

The State of Pennsylvania is very transparent and annually publishes a detailed report including company name, industry and amount of state R&D Tax Credit. In 2019, approximately one thousand taxpayers received a PA R&D tax credit. The approximate 1,000 taxpayers received $55 Million in R&D Tax Credits for the 2019 tax year. Of the 1,000 awarded taxpayers, 572 of them were not in the manufacturing industry.

Even some of these companies who were not profitable benefitted from the credit, thanks to the feature of the Pennsylvania state tax credit that gives the ability to sell unused tax credits to others. This feature as of February 2020, has amounted to $122 million of the $673 million awarded R&D tax credits to be sold between 2003 and 2019. This method is especially beneficial for small businesses that incur research expenses but have no tax liability to offset. Pennsylvania recognizes the importance of innovation in businesses of all sizes and across all industries.

Conclusion

Military interest and investment in 3D printing is growing. The recent development of a portable 3D printing factory is groundbreaking. Military operations from humanitarian efforts to combat will forever be changed with the ability to on-demand 3D print critical parts in even more crucial moments.