Charles R. Goulding and Preeti Sulibhavi look at the implications on the industry of GE’s upcoming split.

GE is breaking up. As the saying goes, “breaking up is hard to do.” Nothing could be closer to the truth.

Three years after Larry Culp took the helm at GE, the plans to split into three business segments have been revealed. Once a founding member of the Dow Jones Industrial Average in 1896, GE spent over a century in a venerable stock index position.

The traditional symbol of US business and economic power will now be three public companies. The industrial giant, known for everything from jet engines to washing machines, is now trying to simplify its portfolio. “Spins create a lot of value,” said Culp who is gearing to make GE a leader in business performance again. Thereby ending an era of conglomerate power.

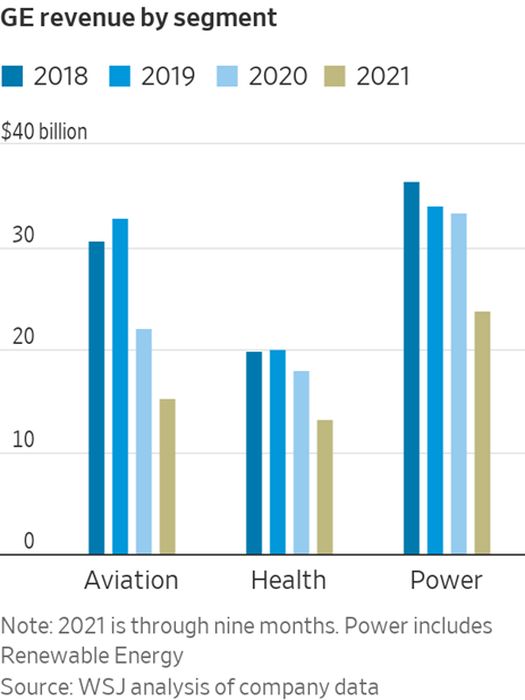

The three spin-offs will be a healthcare company, an aviation company, a segment focusing on energy. The aviation company will inherit GE’s balance sheet assets and liabilities and will be run by Culp himself.

This split follows other recent conglomerate split-ups including 1. DuPont/Dow 2. Siemens Health-Tech business, and 3. United Technologies spun off Otis Elevator and Carrier HVAC. All of these we covered. We also wrote extensively about previous GE’s spinouts leading up to this final split up including, GE’s multiple previous spin-offs including GE lighting, oil and gas with Baker Hughes and the appliance business.

GE Healthcare

Supported by its Edison intelligence platform, GE Healthcare enables clinicians to make faster, more informed decisions through intelligent devices, data analytics, applications, and services. This healthcare segment is a global leader in delivering medical technology, pharmaceutical diagnostics, and digital solutions. GE’s two multinational connections in this business are Siemens Healthineers and Philips Healthcare.

Energy Segment

GE services in the energy industry range from gas power, steam power, nuclear, power conversion and energy consulting. GE helps connect the physical and digital worlds whether it is in the power and utilities, oil and gas, hydropower, or marine environmental solutions sectors. GE offshore helps companies meet the requirements of ship operators and energy companies from drilling and production to specialist and support vessels.

GE’s power conversion offerings include motors, generators, automation and control, and more.

Aviation Business

When a commercial or military aircraft manufacturer requires components and integrated systems and jet engines, they turn to GE aviation. By slimming down to an aviation company, the legacy GE company is betting that the aviation industry is going to be returning to pre-pandemic levels.

The aviation industry is one of the largest users of 3D printing technologies. Additive manufacturing (AM) has been used to fabricate aviation components, from aircraft engines, systems, and avionics.

GE has its own large 3D printing business segment, GE Additive, and we presume that business will remain with GE Aviation. GE Aviation invests more than $1 billion each year in research and development, well-positioning the company to lead advancements in aviation for ages to come.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

The authors’ view is that these conglomerate breakups are good for the 3D printing industry. The spin-out companies will by nature be more focused and can implement the specific 3D printing strategies that best suit their own needs. Conglomerates tend to approach new initiatives like 3D printing as shared services, which is sub-optimal. For example, the 3D printing opportunities for med-tech are often completely different than the 3D printing needs for aviation.